Offer In Compromise Application - Tennessee Department Of Revenue Page 24

ADVERTISEMENT

TENNESSEE DEPARTMENT OF REVENUE

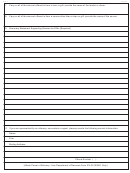

POWER OF ATTORNEY

PART 1

Power of Attorney (Please type or print.)

1. Taxpayer Information (Taxpayer must sign and date this form on line 6.)

Account number(s)

Taxpayer name and address

Daytime telephone number

(

)

hereby appoints the following representative as attorney-in-fact:

2. Representative (Representative must sign and date this form on page 2, Part II.)

Name and address

Telephone No. (

)

Fax No. (

)

Email Address

to represent the taxpayer before the Tennessee Department of Revenue for the following tax matters:

3. Tax Matters

Type of Tax (Sales and Use, Franchise, Excise, etc.)

Year(s) or Period(s)

4. Acts Authorized. --The representative is authorized to receive and inspect confidential tax information and to perform any and all

acts that I can perform with respect to the tax matters described in line 3, for example, the authority to sign any agreements,

consents, or other documents. The authority does not include the power to receive refund checks.

5. Notices and Communication. --Notices and other written communications will be sent to the first representative listed in line 2.

6. Signature of Taxpayer.- If signed by a corporate officer, partner, guardian, tax matters partner/person, executor, receiver, admin-

istrator, or trustee on befalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

Date

Signature

Title (if applicable)

Print Name

RV-0103801

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25