Offer In Compromise Application - Tennessee Department Of Revenue Page 18

ADVERTISEMENT

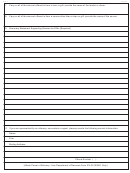

CS-14C

Page 18

(If additional space is needed,

STATEMENT OF FINANCIAL CONDITION

State of Tennessee

FOR BUSINESSES

attach separate sheet)

Department of Revenue

SECTION I - BUSINESS IDENTIFICATION

1. Business Name and Address

2. Mailing Address (If Different From Street Address)

County

4. Daytime Phone Number

5. Number of Employees

3. Type of Business

6. Type of Ownership

[ ] LLC

7. Tennessee Entity ID:

[ ] Proprietorship

[ ] Partnership

[ ] Corporation

[ ] Other (Specify)

9. Ending Date of Business (If Closed) (mm/dd/yyyy)

8. Beginning Date of Business (mm/dd/yyyy)

Form

Tax Year Ended

Net Income

10. Last Franchise Excise Return Filed

$

11. Information About Owner, Partners, Officers, Major Shareholders, etc.

Effective

Monthly

Total Shares

Social Security

Date

Name

Title

Salary or Wages

or Interest

Number

(mm/yy)

$

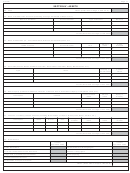

SECTION II - ASSETS

12. Cash On Hand

$

TOTAL (Enter also on Page 3, Item 24-A)

13. Bank Accounts (General Operating, Payroll, Savings, Certificate of Deposit, etc.)

Balance

Name of Institution

Account Number

Type of Account

$

$

TOTAL (Enter also on Page 3, Item 24-B)

14. Bank Credit Available (Line of Credit, Credit Cards, etc.)

Credit

Credit

Amount

Name of Institution

Account Number

Limit

Owed

Available

$

$

$

$

TOTAL (Enter also on Page 3, Item 24-C)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25