Offer In Compromise Application - Tennessee Department Of Revenue Page 4

ADVERTISEMENT

OIC-1 INSTRUCTIONS

Page 4

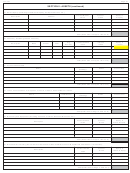

HOW TO CALCULATE AN OFFER

A statement of Financial Condition should be completed in order to determine the amount of the offer. Form CS-14-B for

individuals or Form CS-14C for businesses should be used for this purpose. The applicant’s net worth and disposable income

as determined by the financial statement should form the basis for the offer because these amounts are otherwise available to

the Department as sources of collection. Please use the worksheet below to assist in calculating the value of financial

resources upon which the offer may be based.

“DOUBT AS TO COLLECTABILITY” OFFER

Individual

1) Net Worth [Item 32, from Form CS 14B]

$ ______________

2) Net Monthly Household Disposable Income x 60 [Item 42, from Form CS-14B]

$ ______________

3) Total Value [Combine Items 1 and 2]

$ ______________

Business

1) Net Worth [Item 26, from Form CS 14C]

$ ______________

2) Net Monthly Income x 60 [Item 28, from Form CS-14C]

$ ______________

3) Total Value [Combine Items 1 and 2]

$ ______________

The total of Net Worth plus Net Household Disposable Income (Net Worth plus Net Income if a business) is a factor that

the Department will take into consideration when evaluating whether the taxpayer can pay the liability in full. If the Total

Value is greater than the total tax liability then it should be considered that the applicant has financial resources sufficient to

pay in full and should not apply for an offer. (Note: If the applicant is self-employed, combine the Total Value amounts for

individual and business to determine a reasonable offer amount.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25