Offer In Compromise Application - Tennessee Department Of Revenue Page 13

ADVERTISEMENT

CS-14B

Page 13

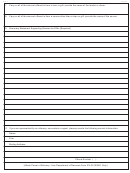

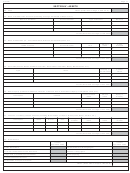

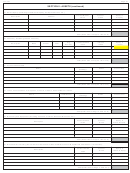

SECTION VIII - INCOME & EXPENSE ANALYSIS

42. Monthly Household Disposable Income

Source

Taxpayer

Spouse

1. Gross Monthly Income

Salary, Wages, Commissions, Tips

$

$

Self-Employment Income

$

$

Pensions, Disability & Social Security

$

$

Dividends & Interest

$

$

Gift or Loan Proceeds

$

$

Rental Income

$

$

Estate, Trust & Royalty Income

$

$

Workers' Compensation & Unemployment

$

$

Alimony & Child Support

$

$

$

$

Other (Specify)

$

$

Other (Specify)

$

$

Other (Specify)

Other (Specify)

$

$

Total Gross Monthly Income: $

$

2. Witholdings

Total Monthly Taxes Witheld: $

$

Individual Net Monthly Incomes

: $

$

("Total Gross Monthly Income" Minus "Total Monthly Taxes Witheld")

Net Monthly Household Disposable Income

:

$

(Combine Individual Net Monthly Incomes)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25