Offer In Compromise Application - Tennessee Department Of Revenue Page 6

ADVERTISEMENT

Page 6

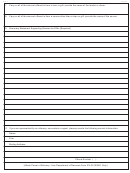

OIC-1

Tennessee Department of Revenue

Offer in Compromise Application

SS #

1. Applicant(s) Name and Street Address

SS #

FEI #

Email Address :

Daytime Phone # (

)

2. Applicant(s) Mailing Address (If different from above)

3. Applicant(s) Legal Structure

[

] Individual

[

] Proprietorship

[

] Partnership

[

] Corporation

[

] LLC

[

] Corp. Officer(s)

4. REQUIRED: I/We Offer to pay the amount of $

to compromise and settle the tax liabilities

listed in Section 6 below and will pay this amount in the following manner: (Check One Only)

[

] Paid in full with this offer. (Make check payable to the “Tennessee Department of Revenue”)

[

] A deposit of $

is attached, the balance to be paid within 30 days from acceptance.

[

] Offer will be paid in

monthly payments of

.

5. The Tennessee Department of Revenue will immediately deposit any payment made with this offer. The deposit of

this payment constitutes neither a waiver of any of the Department’s rights, nor acceptance of the offer.

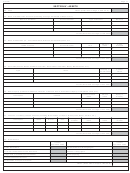

6. Description of Tax Liabilities To Be Compromised

Tax Type

Account Number

Period(s)

[

] Individual Income Tax

[

]

Sales & Use Tax

[

] Franchise & Excise Tax

[

]

Business Tax

[

]

Other (Specify)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

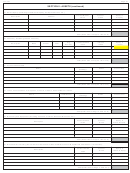

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25