Offer In Compromise Application - Tennessee Department Of Revenue Page 5

ADVERTISEMENT

OIC-1 INSTRUCTIONS

Page 5

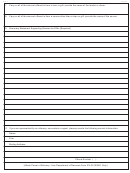

INSTRUCTIONS FOR COMPLETING FORM OIC-1

Item 1 Enter the applicant’s full name, street address, social security, and/or FEI number as applicable, and daytime phone

number. If the tax liability is owed by more then one person, identify each person or business for which the offer is made.

Item 2 Enter the mailing address, if different from the street address.

Item 3 Place an “X” in the box next to the term or terms that identifies the applicant’s legal structure.

Item 4 Enter the offer amount. (Refer to page 3 of these instructions, “How To Calculate An Offer”.) Place an “X” in the box

next to the method of payment, and indicate the preferred payment terms.

Item 6 Place an “X” to identify the involved tax type(s). Specify the account number and the period for which the offer is

made. Please contact the Department if you need to confirm any periods of liability.

Item 7 Identify the source of the amount offered if from a loan or gift.

Item 8 Identify the source of the amount offered if not from yourself.

Item 9 Provide a detailed statement explaining the reason for the offer. You may attach any documents that support the

statement.

Item 10 A completed and signed Power of Attorney Form (Department of Revenue Form RV-F0103801) must be attached if

an attorney, accountant, or other agent represents you.

Item 11 It is important that the Terms and Conditions listed in this section are understood. Pay particular attention to Items

“d” and “g”, as they address future compliance provisions and refund offers. All persons submitting the offer must sign and

date the application.

Item 12 The applicant may at his discretion, allow the Department to exchange information regarding a pending or completed

offer with the IRS. All information in this section must be provided including applicant signature(s) and date.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25