Offer In Compromise Application - Tennessee Department Of Revenue Page 9

ADVERTISEMENT

Page 9

OIC-1

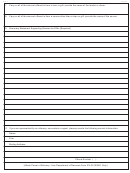

12. DISCLOSURE AGREEMENT

This section is to be completed only if an Offer In Compromise is currently pending or has been recently acted upon by the

IRS for the applicant. Separate signature(s) are required for this section.

[

] Completed

(Date

)

[

] Accepted (Amount $

) or [

] Declined

(mm/dd/yyyy)

[

] Pending

(Date

)

IRS Agent Assigned

(mm/dd/yyyy)

[

] To be Filed

(Date

)

Phone Number

(mm/dd/yyyy)

Tax Period(s) Covered

Amount Owed

SS # or FEI #

$

By my/our signature(s) below, I/we authorize the Tennessee Department of Revenue and the Internal Revenue Service to

exchange information from their respective files regarding my/our pending or completed Offer in Compromise.

APPLICANT’S SIGNATURE

DATE

APPLICANT’S SIGNATURE

DATE

POWER OF ATTORNEY'S SIGNATURE

DATE

For information or assistance, contact your Revenue Collection Officer directly or reach the Collection

Services Division at (615) 741-7074 or Revenue.Collection@tn.gov.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25