Form 740-Np - Kentucky Income Tax Return Nonresident Or Part-Year Resident - 2012 Page 13

ADVERTISEMENT

Line 23, Education Tuition Tax Credit—Complete Form 8863-K

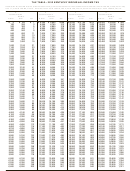

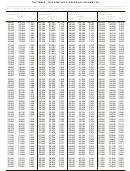

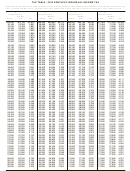

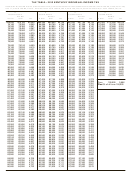

Optional Use Tax Table

to claim this credit. See Forms and instructions.

KY AGI* Tax

Line 25, Child and Dependent Care Credit—Full-year

$0 - $10,000 ....................................... $4

nonresidents are not entitled to this credit. Part-year residents

$10,001 - $20,000 ............................ $12

may be entitled to a credit for child and dependent care

$20,001 - $30,000 ............................ $20

expenses paid while a resident of Kentucky. To determine this

$30,001 - $40,000 ............................ $28

credit, complete the following worksheet.

$40,001 - $50,000 ............................ $36

$50,001 - $75,000 ............................ $50

$75,001 - $100,000 .......................... $70

a.

Enter total credit calculated on federal

Above $100,000 ............................... Multiply AGI by 0.08%

Form 2441, Line 9 ............................... _________________

(0.0008)

* AGI from Line 9 on KY Form 740 or KY Form 740-NP or Line

b.

Enter total child and dependent care

1 on KY Form 740-EZ.

expenses entered on Form 2441,

Line 3 ................................................... _________________

Use Tax Calculation Worksheet

c. Enter the amount included on

Call 502-564-5170 for assistance.

Line b paid while a Kentucky

resident ................................................ _________________

d.

Divide Line c by Line b.

1. Purchases of $0 to $1,000

Enter result ..........................................

___ . ___ ___

x 6 percent (.06)

$

OR Use Tax Table Amount

e.

Multiply the amount on Line a

2. Purchases of $1,000 or more

by the decimal amount on Line d ..... _________________

$

x 6 percent (.06)

3. Total Use Tax Due (add lines 1 and

f.

Percent of allowable credit for

x

.20

$

2)

Kentucky .............................................. _________________

Report this amount on Form 740 or 740-NP, Line 27; or 740-EZ,

Line 9.

g.

Multiply the amount on Line e

by the decimal amount on Line f.

This is your Child and Dependent

Note: The items reported for use tax on Form 740-NP should

Care Credit. Enter on Line 25 ............. _________________

be those purchased strictly for personal use. Any use tax

liabilities accruing to a business such as mail-order office

Note: If you and your spouse are filing separate Kentucky

supplies must be reported on the sales and use tax return or

returns, the child and dependent care credit calculated for

the consumer's use tax return. The Department of Revenue

Kentucky must be divided based on the percentage of each

routinely conducts compliance programs with other states

spouse's adjusted gross income to total Kentucky adjusted

regarding out-of-state purchases. Persons not reporting

gross income (Line 9).

applicable use tax will be liable for the tax plus interest and

penalties.

Line 27, Kentucky Use Tax—If, while a Kentucky resident, you

Credit Against the Kentucky Use Tax Due

made any out-of-state purchases of tangible personal property

or digital property for use in Kentucky on which sales tax

You may reduce or eliminate the amount of Kentucky use tax

was not charged, you must report Kentucky use tax on those

due by the amount of state sales tax paid to the out-of-state

purchases, pursuant to KRS 139.330. For example, if you order

seller on the same transaction. The reduction may not exceed

from catalogs, make purchases through the Internet, or shop

the amount of Kentucky use tax due on the purchase. For

outside Kentucky for items such as clothing, shoes, jewelry,

example, if Georgia state sales tax of 4 percent is paid, only

cleaning supplies, furniture, computer equipment, pre-written

the additional 2 percent is due to Kentucky, or if Illinois state

computer software, office supplies, books, souvenirs, exercise

sales tax of 6.25 percent is paid, no additional Kentucky use

equipment or subscribe to magazines, you may owe use tax

tax is due. Sales tax paid to a city, county or another country

to Kentucky.

cannot be used as a credit against Kentucky use tax due.

Line 30(a), Tax Withheld—Enter the amount of 2012 Kentucky

For your convenience, the Use Tax Calculation Worksheet and

income tax withheld by your employer(s). This amount is

Optional Use Tax Table are provided in these instructions. The

shown on wage and tax statements, including Forms 1099

Optional Use Tax Table is designed for those purchases of

and W-2G, which you must attach to Form 740-NP in the

less than $1,000. If you made untaxed out-of-state purchases

designated area. You will not be given credit for Kentucky

in amounts under $1,000, but do not have records readily

income tax withheld unless you attach the wage and tax

available that show the amount of those purchases, you

statements or other supporting documents reflecting

may use the Optional Use Tax Table below to estimate the

Kentucky withholding.

compensating use tax based on your Kentucky Adjusted Gross

Income (KYAGI). All untaxed purchases in the amount of $1,000

Employers are required to give these statements to employees

or greater must be accounted for on an actual basis using the

no later than January 31, 2013. If by March 1 you are unable

Use Tax Calculation Worksheet. Failure to timely report may

to obtain a wage and tax statement from an employer, contact

result in assessment of penalty and interest in addition to the

the Department of Revenue for instructions.

tax amount due.

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60