Form 740-Np - Kentucky Income Tax Return Nonresident Or Part-Year Resident - 2012 Page 48

ADVERTISEMENT

apply: (1) the loan was used to buy, build or improve your

This generally does not apply to points paid to refinance your

main home, and was secured by that home, (2) the points

mortgage. Federal rules apply. See federal Publication 936

did not exceed the points usually charged in the area where

for more information.

the loan was made, and were figured as a percentage of the

loan amount, and (3) if the loan was used to buy or build the

home, you must have provided funds (see below) at least

Line 13, Qualified Mortgage Insurance Premiums—Premiums

equal to the points charged. If the loan was used to improve

that you pay or accrue for “qualified mortgage insurance”

the home, you must have paid the points with funds other

during 2012 in connection with home acquisition debt on your

than those obtained from the lender.

qualified home are deductible as home mortgage insurance

premiums. Qualified mortgage insurance is mortgage insurance

Funds provided by you include down payments, escrow

provided by the Veterans Administration, the Federal Housing

deposits, earnest money applied at closing, and other

Administration, or the Rural Housing Administration, and

amounts actually paid at closing. They do not include

private mortgage insurance. Mortgage insurance premiums

amounts you borrowed as part of the overall transaction.

you paid or accrued on any mortgage insurance contract issued

before January 1, 2007, are not deductible.

Seller-Paid Points—If you are the buyer, you may be able to

deduct points the seller paid in 2012. You can do this if the

loan was used to buy your main home and the points meet

Limit on amount you can deduct. You cannot deduct your

item 2 above. You must reduce your basis in the home by

mortgage insurance premiums if the amount on Form 740-NP,

those points, even if you do not deduct them.

line 8, is more than $109,000 ($54,500 if married filing separate

The seller cannot deduct these points as interest. However,

returns). If the amount on Form 740-NP, line 8, is more than

they are a selling expense that reduces the amount realized

$100,000 ($50,000 if married filing separate returns), your

by the seller. See federal Publication 523 for information on

deduction is limited and you must use the worksheet below

selling your home.

to figure your deduction.

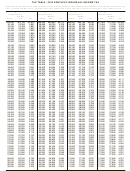

Qualified Mortgage Insurance Premiums Deduction Worksheet

See the instructions for Line 13 above to see if you must use this worksheet to figure your deduction.

1. Enter the total premiums you paid in 2012 for qualified mortgage insurance for a

contract entered into on or after January 1, 2007 ..........................................................

1. __________________

2. Enter the amount from Form 740-NP, page 1, Line 8 ......................................................

2. _________________

3. Enter $100,000 ($50,000 if married filing separate returns) ............................................

3. _________________

4. Is the amount on Line 2 more than the amount on Line 3?

No. Your deduction is not limited. Enter the amount from Line 1 above

on Schedule A, Line 13.

Yes. Subtract Line 3 from Line 2. If the result is not a multiple of $1,000

($500 if married filing separate returns), increase it to the next

multiple of $1,000 ($500 if married filing separate returns). For

example, increase $425 to $1,000, increase $2,025 to $3,000;

or if married filing separate returns, increase $425 to $500,

increase $2,025 to $2,500, etc. .............................................................................

4. __________________

5. Divide Line 4 by $10,000 ($5,000 if married filing separate returns).

Enter the result as a decimal. If the result is 1.0 or more, enter 1.0 ...............................

5. __________________

6. Multiply Line 1 by Line 5 ....................................................................................................

6.___________________

7. Qualified mortgage insurance premiums deduction. Subtract Line 6 from Line 1.

Enter the result here and on Schedule A, Line 13 ............................................................

7. __________________

14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60