Form 740-Np - Kentucky Income Tax Return Nonresident Or Part-Year Resident - 2012 Page 15

ADVERTISEMENT

EXTENSION OF TIME TO FILE

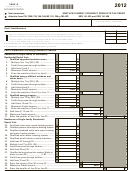

Kentucky Limited Liability Entity Tax Credit Worksheet

Taxpayers who are unable to file a return by April 15, 2013,

Complete a separate worksheet for each LLE. Retain for your

may request an extension. Inability to pay is not an acceptable

records.

reason. Acceptable reasons include, but are not limited to,

destruction of records by fire or flood and serious illness of

Name __________________________________________________

the taxpayer. The request for the extension must be submitted

in writing to the Department of Revenue on or before the due

Address ________________________________________________

date of the return. The request must state a reasonable cause

for the inability to file. Extensions are limited to six months.

FEIN ___________________________________________________

A copy of the Kentucky extension request must be attached

%

to the return.

Percentage of Ownership ....................... ________________

Individuals who receive a federal extension are not required

1. Enter Kentucky taxable income

to obtain a separate Kentucky extension. They can meet the

from Form 740-NP, Line 13 ................ ________________

requirements by attaching a copy of the application for auto-

2. Enter LLE income as shown

matic federal extension or the approved federal extension to

on Kentucky Schedule K-1

the Kentucky return.

or Form 725 ........................................ ________________

Kentucky residents who are in the military are often granted

3. Subtract Line 2 from Line 1 and

extensions for tax filings when serving outside the United

enter total here ................................... ________________

States. Any extension granted for federal income tax purposes

4. Enter Kentucky tax on income

will be honored for Kentucky income tax purposes.

amount on Line 1 ................................ ________________

5. Enter Kentucky tax on income

Interest at the "tax interest rate" applies to any income tax

amount on Line 3 ................................ ________________

paid after the original due date of the return. If the amount of

6. Subtract Line 5 from Line 4. If Line 5

tax paid by the original due date is less than 75 percent of the

is larger than Line 4, enter zero.

tax due, a late payment penalty may be assessed (minimum

This is your tax savings if income

penalty is $10). Interest and late payment penalty charges can

is ignored ............................................ ________________

be avoided by remitting payment with the Extension Payment

7. Enter nonrefundable limited liability

Voucher by the due date.

entity tax credit (from Kentucky

Schedule K-1 or Form 725) ............... ________________

If you wish to make a payment prior to the due date of your

8. Enter the lesser of Line 6 or Line 7.

tax return, complete Section II of the Application for Extension

This is your credit. Enter here and

of Time to File, Form 40A102, and remit with payment. Write

on Form 740-NP, Section A, Line 1 ... ________________

"KY Income Tax—2012" and your Social Security number on

the face of the check.

Line 2, Kentucky Small Business Investment Credit—For

Personal Property—Kentucky taxpayers are reminded to report

taxable years beginning after December 31, 2010, a small

all taxable personal property, except motor vehicles, owned

business may be eligible for a nonrefundable credit of up to one

on January 1 to either the property valuation administrator in

hundred percent (100%) of the Kentucky income tax imposed

the county of residence (or location of business) or the Office

under KRS 141.020 or 141.040, and the limited liability entity

of Property Valuation in Frankfort. Tangible personal property

tax imposed under KRS 141.0401.

is to be reported on the Tangible Personal Property Tax Return,

Form 62A500. The due date for these returns is May 15.

The small business development credit program authorized

by KRS 154.60-020 and KRS 141.384 was amended to allow

the credit to apply to taxable years beginning after Dec. 31,

SECTION A—BUSINESS INCENTIVE AND OTHER TAX CREDITS

2010. The definition of base year for purposes of the credit

computation was changed to the first full year of operation that

Line 1, Nonrefundable Limited Liability Entity Tax Credit

begins on or after Jan.1, 2009 and before Jan. 1, 2010.

(KRS 141.0401(2))

Small businesses are eligible to apply for credits and receive

An individual that is a partner, member or shareholder of a

final approval for these credits one (1) year after the small

limited liability pass-through entity is allowed a limited liability

business:

entity tax (LLET) credit against the income tax imposed by KRS

141.020 equal to the individual's proportionate share of LLET

•

Creates and fills one (1) or more eligible positions over

computed on the gross receipts or gross profits of the limited

the base employment, and that position or positions are

liability pass-through entity as provided by KRS 141.0401(2),

created and filled for twelve (12) months; and

after the LLET is reduced by the minimum tax of $175 and

by other tax credits which the limited liability pass-through

•

Invests five thousand dollars ($5,000) or more in qualifying

entity may be allowed. The credit allowed an individual that is

equipment or technology.

a partner, member, or shareholder of a limited liability pass-

through entity against income tax shall be applied only to

The small business shall submit all information necessary to

income tax assessed on the individual's proportionate share

the Kentucky Economic Development Finance Authority to

of distributive income from the limited liability pass-through

determine credit eligibility for each year and the amount of

entity as provided by KRS 141.0401(3)(b). Any remaining LLET

credit for which the small business is approved.

credit shall be disallowed and shall not be carried forward to

the next year.

A small business that is a pass-through entity not subject

to the tax imposed by KRS 141.040 and that has tax credits

Nonrefundable Kentucky limited liability entity tax credit

approved under Subchapter 60 of KRS Chapter 154 shall apply

(KRS 141.0401(2))—The credit amount is shown on Kentucky

the credits against the limited liability entity tax imposed by

Schedule(s) K-1 from pass-through entities (PTEs) or Form(s)

KRS 141.0401, and shall also distribute the amount of the

725 for single member limited liability companies. Copies of

approved tax credits to each partner, member, or shareholder

Kentucky Schedule(s) K-1 or Form(s) 725 must be attached

based on the partner’s, member’s, or shareholder’s distributive

to your return.

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60