Form 740-Np - Kentucky Income Tax Return Nonresident Or Part-Year Resident - 2012 Page 8

ADVERTISEMENT

• Relationship—The taxpayer’s child or stepchild (whether by

The department may provide official information on a confi-

blood or adoption), foster child, sibling or stepsibling, or a

dential basis to the Internal Revenue Service or to any other

descendant of one of these.

governmental agency with which it has an exchange of infor-

• Residence—Has the same principal residence as the tax-

mation agreement whereby the department receives similar

payer for more than half the tax year. A qualifying child is

or useful information in return.

determined without regard to the exception for children of

divorced or separated parents. Other federal exceptions

REPORTING PERIODS AND ACCOUNTING PROCEDURES—

apply.

Kentucky law requires taxpayers to report income on the

• Age—Must be under the age of 19 at the end of the tax year,

same calendar or fiscal year and to use the same methods of

or under the age of 24 if a full-time student for at least five

accounting as required for federal income tax purposes. Any

months of the year, or be permanently and totally disabled

federally approved change in accounting period or methods

at any time during the year.

must be reported to the Kentucky Department of Revenue.

• Support—Did not provide more than one-half of his/her

Attach a copy of the federal approval.

own support for the year.

Changes to federal income tax law made after the Internal

Modified Gross Income—Modified gross income is the greater

Revenue Code reference date contained in KRS 141.010(3)

of federal adjusted gross income adjusted to include inter-

shall not apply for purposes of Chapter 141 unless adopted

est income derived from municipal bonds (non-Kentucky)

by the General Assembly.

and lump-sum pension distributions not included in federal

adjusted gross income; or Kentucky adjusted gross income ad-

POLITICAL PARTY FUND DESIGNATION—You may designate

justed to include lump-sum pension distributions not included

that a portion of your taxes will be paid to either the Democratic

in federal adjusted gross income.

or Republican parties if you have a tax liability of at least $2 ($4

for married persons filing joint returns). This designation will

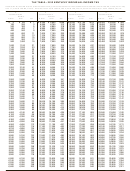

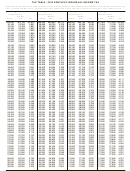

Chart A

not increase your tax or decrease your refund. You may make

Your Modified Gross

this designation by checking the applicable box. A husband

If Your Family Size is:

Income is greater than:

and wife may each make a designation. Persons making no

designation should check the "No Designation" box.

One ............................. and ............................ $ 11,170

FILING STATUS—Legal liabilities are affected by the choice

Two ............................ and ............................ $ 15,130

of filing methods. Married persons who file joint returns are

Three .......................... and ............................ $ 19,090

jointly and severally liable for all income taxes due for the

period covered by the return. If married, you may file separate

Four or More ............. and ............................ $ 23,050

or joint returns. Most married persons pay less tax if they file

separate returns.

WHEN TO FILE—April 15, 2013, is the filing deadline for

Filing Status 1, Single—Use this filing status if you are

persons reporting income for calendar year 2012. To avoid

unmarried, divorced, widowed, legally separated by court

penalties and interest, returns must be postmarked no later

decree, or if you filed as "Head of Household" or "Qualifying

than April 15, 2013.

Widow(er)" on your federal return.

Social Security Number—You are required to provide your

Filing Status 2, Married Filing Joint Return—Use this filing

social security number per Section 405, Title 42, of the United

status if you and your spouse choose to file a joint return even

States Code. This information will be used to establish your

if one spouse had no income. Jointly means that you and your

identity for tax purposes only.

spouse add your incomes together and report the total on page

4, Section D, Column B, Lines 1 through 34.

AMENDED RETURNS—If you discover that you omitted

deductions or otherwise improperly prepared your return, you

Filing Status 3, Married Filing Separate Returns—If using this

may obtain a refund by filing an amended return within four

filing status, you and your spouse must file two separate tax

years of the due date of the original return. You are required

forms. The husband's income is reported on one tax form, the

to file an amended return to report omitted income.

wife's on the other. When filing separate returns, the name and

Social Security number of each spouse must be entered on

When filing an amended return, check the box on Form 740-NP

both returns. Enter the spouse's Social Security number in the

and attach a detailed explanation of the changes to income,

block provided, and enter the name on page 1, Line 3.

deductions and tax. Submit a completed Kentucky return and

corrected federal schedules, if applicable. If you do not attach

DETERMINING YOUR INCOME

the required information, processing of your amended return

may be delayed.

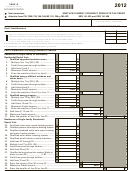

SECTION D—INCOME/ADJUSTMENTS TO INCOME

COMPOSITE RETURNS—Beginning with tax year 2009, the fil-

A copy of pages 1 and 2 of your federal income tax return and

ing of a composite return on Form 740-NP is no longer allowed.

all supporting schedules must be filed with Kentucky Form

You must use Form 740NP-WH, Kentucky Nonresident Income

740-NP. Please clearly identify as "Copy."

Tax Withholding on Net Distributive Share Income Transmittal

Report and Composite Income Tax Return.

INSTRUCTIONS FOR COLUMN A

CONFIDENTIALITY—Kentucky Revised Statute 131.190 requires

the Department of Revenue to maintain strict confidentiality

All entries in Column A should be amounts reported for federal

of all taxpayer records. No employee of the Department of

income tax purposes.

Revenue may divulge any information regarding the tax

returns, schedules or reports required to be filed. However,

Depreciation—Assets Purchased After September 10, 2001

the Department of Revenue is not prohibited from providing

evidence to or testifying in any court of law concerning official

Effective for taxable years ending after September 10, 2001, an

tax records.

individual that for federal income tax purposes elects to utilize

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60