Form 740-Np - Kentucky Income Tax Return Nonresident Or Part-Year Resident - 2012 Page 9

ADVERTISEMENT

the 30 percent or the 50 percent special depreciation allowance

Lines 7 and 12, Profit or (Loss) from Business or Farming—

or the increased 179 deduction will have a different deprecia-

For income taxable to Kentucky, complete and attach federal

tion and Section 179 deduction for Kentucky purposes than for

Schedule C or C-EZ for business income or federal Schedule F

federal purposes. The differences will continue through the life

for farming and Form 4562, Depreciation and Amortization. Do

of the assets. There will be recapture and basis differences for

not adjust wages by the federal work opportunity credit from

Kentucky and federal income tax purposes until the assets are

federal Form 5884. For passive activities, see Form 8582-K.

Do not include income from the national tobacco settlement

sold or fully depreciated.

agreement. Adjust income for the difference in allowable de-

INSTRUCTIONS FOR COLUMN B

preciation and report in Column B.

Depreciation, Section 179 Deduction and Gains/Losses From

Note: Individual owners of disregarded single member

LLCs (SMLLCs) that file on Schedules C, E, or F for federal

Disposition of Assets—Important: Follow the instructions for

Reporting Depreciation and Section 179 Deduction Differences

income tax shall file Form 725, Kentucky Single Member LLC

if you have elected for federal income tax purposes to take the

Individually Owned LLET Return, to compute and pay the

30 percent or the 50 percent special depreciation allowance

limited liability entity tax. The individual member shall report

or the increased Section 179 deduction for property placed

income or loss from the entity and determine credit in the same

in service after September 10, 2001. A copy of the federal

manner as other pass-through entities (PTEs).

Form 4562 if filed for federal income tax purposes must be

submitted with Form 740-NP to verify that no adjustments

Lines 8 and 9, Gain or (Loss) from Sale or Exchange of Assets—

are required.

Gains (losses) on sales of assets (including installment sales)

while a Kentucky resident must be reported on the Kentucky

Repor ting Depreciation and Sec tion 179 Deduc tion

return. Gains (losses) on sales of tangible assets located in

Differences for property placed in service after September

Kentucky must be reported regardless of state of residence.

10, 2001—Create a Kentucky Form 4562 by entering Kentucky

Generally, gains (losses) on sales of intangible assets are

at the top center of a federal Form 4562 above Depreciation

reported to the state of residence.

and Amortization. In Part I replace the $139,000 maximum

amount on Line 1 with the Kentucky limit of $25,000 and

Determining and Reporting Differences in Gain or Loss From

replace the $560,000 threshold amount on Line 3 with the

Disposition of Assets—If during the year you dispose of assets

Kentucky phase-out threshold of $200,000. In Part II, strike

placed in service after September 10, 2001, on which the 30

through and ignore Line 14, Special depreciation allowance

percent or the 50 percent special depreciation allowance or the

for qualified property placed in service during the tax year.

increased Section 179 deduction was taken for federal income

Use the created Kentucky Form 4562 to compute Kentucky

tax purposes, you will need to determine and report the differ-

depreciation and Section 179 deduction in accordance with

ence in the amount of gain or loss on the assets as follows:

the IRC in effect on December 31, 2001.

Create a Kentucky form by entering Kentucky at the top center

Note: In determining the Section 179 deduction for Kentucky,

of a federal Schedule D, federal Form 4797 and other applicable

the income limitation on Line 11 is Kentucky net income

federal forms. Compute Kentucky gain or loss from the dis-

before the Section 179 deduction, instead of federal taxable

posed assets using the Kentucky basis. Enter the Kentucky gain

income. Adjust federal Schedules C, E and F for the difference

or loss on the appropriate line. Attach the created Kentucky

in allowable depreciation and report in Column B the Kentucky

Schedule D, Kentucky Form 4797 and other forms or schedules

income (loss) from business, farming or rental property. Attach

to support the deduction.

Kentucky Form 4562 and, if filed, federal Form 4562.

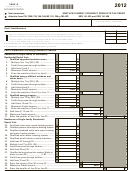

Line 1, Wages, Salaries, Tips, etc.—Enter all wages, salaries,

Line 10(a), Federally Taxable IRA Distributions, Pensions

tips, bonuses, commissions or other compensation received

and Annuities—Enter on Line 10(a), Column A, the total of

for personal services from Kentucky sources while a nonresi-

IRA distributions, pensions and annuities received for the

dent and from all sources while a resident of Kentucky. Do

entire year. Enter on Line 10(a), Column B, the total of IRA

not include in this amount any reimbursement for moving

distributions, pensions and annuities received while a resident

expenses included in Kentucky wages on your wage and tax

of Kentucky.

statement.

Line 10(b), Pension Income Exclusion—You may exclude up to

Line 2, Moving Expense Reimbursement—See instructions

$41,110 of pension income reported on Line 10(a), Column B.

for Schedule ME.

If Line 10(a), Column B, is more than $41,110 and is from the

federal government, Commonwealth of Kentucky or Kentucky

Line 3, Interest—Interest income received while a Kentucky

local governments, complete Schedule P.

resident must be reported, except for the following: (a) income

from bonds issued by the Commonwealth of Kentucky and

Line 11, Income from Schedule E—Enter income from rents,

its political subdivisions; and (b) income from U.S. govern-

royalties, partnerships, estates, trusts, limited liability compa-

ment bonds or securities. Interest income from bonds issued

nies (LLC), S corporations and REMICs. Nonresident individuals

by other states and their political subdivisions is taxable to

receiving a Kentucky Schedule K-1 from a partnership, estate,

Kentucky and must be included on Line 3.

trust, LLC or S corporation must report their distributive

share of the income, gains or losses, etc., as reflected on the

Line 4, Dividends—Report dividends received while a resident

Schedule K-1. Shareholders and partners should multiply

of Kentucky and the distributive share of the dividend income

their distributive share items by the taxable percentage from

reflected on the Schedule K-1.

Schedule K-1; Form 720S, Line B(2); Form 765, Line D(2) and

Form 765-GP, Line C(2).

Line 5, Taxable Refunds, Credits or Offsets of State or Local

Income Taxes—Enter the amount of taxable local income tax

Part-year residents not receiving a Kentucky Schedule K-1,

refund or credit reported on your federal return only if you

but receiving a federal K-1 from a partnership, estate, trust or

received a tax benefit in a prior year. Do not include state

S corporation, must report the same amount of distributive

income tax refunds.

income, gains or losses, etc., as reported for federal income

tax purposes from entities whose taxable years end during

Line 6, Alimony Received—Enter alimony payments received

while a Kentucky resident.

their period of residence.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60