Profitability For Ots-Regulated Private-Sector Thrift Institutions Guide - Office Of Thrift Supervision - U.s. Department Of Treasury - 1998 Page 12

ADVERTISEMENT

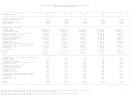

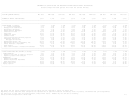

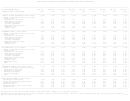

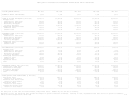

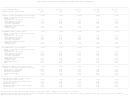

STATEMENT OF OPERATIONS FOR OTS-REGULATED PRIVATE-SECTOR THRIFT INSTITUTIONS

BY REGION

___________________________________________________________________________________________________________________________________________________________________________

|

|

| FOURTH QUARTER 1997:

NORTHEAST

SOUTHEAST

CENTRAL

MIDWEST

WEST

INDUSTRY

|

|

|

| NUMBER OF THRIFT INSTITUTIONS:

257

237

363

256

102

1,215

|

|___________________________________________________________________________________________________________________________________________________________________________|

|

|

| PROFITABILITY ($ Millions)

|

| Interest Income

$2,772.93

$1,148.83

$2,872.40

$1,699.38

$5,575.68

$14,069.21

|

| Interest Expense

1,620.23

660.27

1,754.65

1,061.90

3,513.57

8,610.61

|

|

NET INTEREST INCOME

1,152.70

488.56

1,117.75

637.48

2,062.11

5,458.60

|

| Loss Provisions-Interest Bearing Assets

77.43

71.91

150.76

42.11

162.62

504.83

|

| Noninterest Income

363.16

296.63

462.45

312.58

704.00

2,138.82

|

|

Mortgage Loan Servicing Fees

57.46

14.76

22.17

46.73

84.88

226.00

|

|

Other Fees and Charges

177.51

173.82

162.30

130.13

328.40

972.16

|

|

Other Noninterest Income

128.19

108.05

277.98

135.72

290.72

940.66

|

| Noninterest Expense

867.82

520.61

1,003.17

524.86

1,489.56

4,406.01

|

|

G&A Expense

832.07

494.06

949.37

507.31

1,425.27

4,208.06

|

|

Goodwill Amortization

26.73

15.34

52.60

8.52

44.66

147.84

|

|

Loss Provisions-Noninterest Bearing Assets

9.02

11.21

1.20

9.03

19.63

50.10

|

| Income Before Taxes & Extraordinary Items

570.61

192.67

426.27

383.09

1,113.93

2,686.58

|

| Income Taxes

201.65

72.68

180.38

107.75

424.50

986.96

|

| Extraordinary Items

0.02

(0.66)

0.10

0.00

(0.96)

(1.50)

|

|

NET INCOME

368.98

119.34

245.99

275.35

688.47

1,698.13

|

|___________________________________________________________________________________________________________________________________________________________________________|

|

|

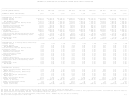

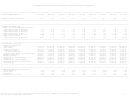

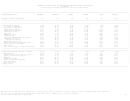

| PROFITABILITY (% of Average Assets Annualized)

|

| Interest Income

7.40%

7.47%

7.46%

7.43%

7.20%

7.34%

|

| Interest Expense

4.32

4.29

4.55

4.64

4.54

4.49

|

|

NET INTEREST INCOME

3.08

3.17

2.90

2.79

2.66

2.85

|

| Loss Provisions-Interest Bearing Assets

0.21

0.47

0.39

0.18

0.21

0.26

|

| Noninterest Income

0.97

1.93

1.20

1.37

0.91

1.12

|

|

Mortgage Loan Servicing Fees

0.15

0.10

0.06

0.20

0.11

0.12

|

|

Other Fees and Charges

0.47

1.13

0.42

0.57

0.42

0.51

|

|

Other Noninterest Income

0.34

0.70

0.72

0.59

0.38

0.49

|

| Noninterest Expense

2.32

3.38

2.60

2.29

1.92

2.30

|

|

G&A Expense

2.22

3.21

2.46

2.22

1.84

2.19

|

|

Goodwill Amortization

0.07

0.10

0.14

0.04

0.06

0.08

|

|

Loss Provisions-Noninterest Bearing Assets

0.02

0.07

0.00

0.04

0.03

0.03

|

| Income Before Taxes & Extraordinary Items

1.52

1.25

1.11

1.67

1.44

1.40

|

| Income Taxes

0.54

0.47

0.47

0.47

0.55

0.51

|

| Extraordinary Items

0.00

0.00

0.00

0.00

0.00

0.00

|

|

NET INCOME

0.98

0.78

0.64

1.20

0.89

0.89

|

|___________________________________________________________________________________________________________________________________________________________________________|

|

|

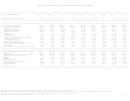

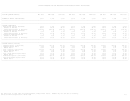

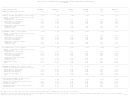

| PROFITABILITY (Percent)

|

|

Return on Average Assets (Annualized)

0.98

0.78

0.64

1.20

0.89

0.89

|

|

Median Ratio

0.72

0.77

0.85

0.78

0.83

0.79

|

|

Return on Average Equity (Annualized)

11.48

8.01

6.99

13.79

12.33

10.74

|

|

Median Ratio

7.35

7.35

7.63

7.84

9.12

7.70

|

|

Net Interest Margin (Annualized)

3.08

3.17

2.90

2.79

2.66

2.85

|

|

Median Ratio

3.35

3.35

3.09

3.10

3.11

3.18

|

|

Number of Profitable Thrifts

237

206

340

233

95

1,111

|

|

Percent Profitable

92.22

86.92

93.66

91.02

93.14

91.44

|

|

Profits ($ Millions)

$376.65

$147.39

$315.11

$281.08

$690.80

$1,811.03

|

|

Number of Unprofitable Thrifts

20

31

23

23

7

104

|

|

Percent Unprofitable

7.78

13.08

6.34

8.98

6.86

8.56

|

|

Losses ($ Millions)

($7.67)

($28.05)

($69.12)

($5.74)

($2.33)

($112.91)

|

|___________________________________________________________________________________________________________________________________________________________________________|

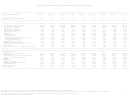

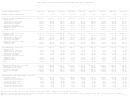

Net income for the third quarter 1996 was significantly reduced by a one-time special assessment fee levied to fully capitalize the SAIF.

See Technical Notes for details.

All data exclude self-liquidating thrifts.

See Technical Notes for details.

All data prior to June 1996 are unconsolidated, except where noted.

Numbers may not sum due to rounding.

Office of Thrift Supervision / March 1998

T-12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30