Profitability For Ots-Regulated Private-Sector Thrift Institutions Guide - Office Of Thrift Supervision - U.s. Department Of Treasury - 1998 Page 3

ADVERTISEMENT

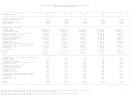

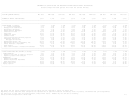

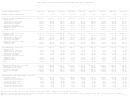

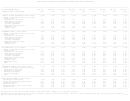

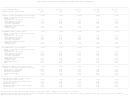

STATEMENT OF OPERATIONS FOR OTS-REGULATED PRIVATE-SECTOR THRIFT INSTITUTIONS

___________________________________________________________________________________________________________________________________________________________________________

|

|

| FOR THE QUARTER ENDING:

DEC 1995

MAR 1996

JUN 1996

SEP 1996

DEC 1996

MAR 1997

JUN 1997

SEP 1997

DEC 1997

|

|

|

| NUMBER OF THRIFT INSTITUTIONS:

1,437

1,416

1,397

1,378

1,334

1,301

1,272

1,238

1,215

|

|___________________________________________________________________________________________________________________________________________________________________________|

|

|

| PROFITABILITY ($ Millions)

|

| Interest Income

$13,935.75

$13,706.74

$13,732.07

$13,882.05

$13,843.65

$13,715.41

$13,732.28

$13,779.55

$14,069.21

|

| Interest Expense

8,738.60

8,362.76

8,224.43

8,403.43

8,384.50

8,156.93

8,297.88

8,414.65

8,610.61

|

|

NET INTEREST INCOME

5,197.15

5,343.98

5,507.63

5,478.62

5,459.15

5,558.48

5,434.39

5,364.90

5,458.60

|

| Loss Provisions-Interest Bearing Assets

515.15

447.02

447.89

514.09

704.88

477.15

494.08

486.75

504.83

|

| Noninterest Income

1,311.23

1,843.84

1,687.32

1,612.74

1,768.68

1,673.66

1,701.58

1,531.46

2,138.82

|

|

Mortgage Loan Servicing Fees

177.61

200.41

223.34

234.35

230.15

223.71

217.59

208.98

226.00

|

|

Other Fees and Charges

561.45

595.95

692.75

720.24

750.98

801.62

818.25

911.90

972.16

|

|

Other Noninterest Income

572.17

1,047.47

771.23

658.15

787.56

648.33

665.73

410.58

940.66

|

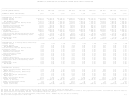

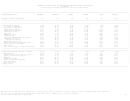

| Noninterest Expense

4,098.51

4,020.95

4,175.07

7,267.20

4,394.82

4,054.55

4,023.64

4,287.72

4,406.01

|

|

G&A Expense

3,849.51

3,836.30

3,981.95

7,113.66

4,205.91

3,888.30

3,830.83

4,112.15

4,208.06

|

|

Goodwill Amortization

186.26

128.62

152.29

125.51

130.75

124.07

131.37

136.38

147.84

|

|

Loss Provisions-Noninterest Bearing Assets

62.74

56.03

40.83

28.04

58.17

42.18

61.44

39.19

50.10

|

| Income Before Taxes & Extraordinary Items

1,894.72

2,719.85

2,571.99

(689.93)

2,128.13

2,700.44

2,618.25

2,121.90

2,686.58

|

| Income Taxes

550.99

897.27

642.59

(456.35)

660.48

974.75

931.35

777.24

986.96

|

| Extraordinary Items

(81.03)

4.80

(2.31)

(249.36)

0.61

(0.21)

(0.32)

(2.72)

(1.50) |

|

NET INCOME

1,262.69

1,827.38

1,927.08

(482.94)

1,468.25

1,725.48

1,686.59

1,341.94

1,698.13

|

|___________________________________________________________________________________________________________________________________________________________________________|

|

|

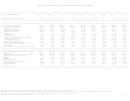

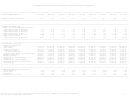

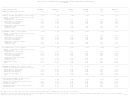

| PROFITABILITY (% of Average Assets Annualized)

|

| Interest Income

7.28%

7.21%

7.19%

7.21%

7.23%

7.22%

7.24%

7.30%

7.34% |

| Interest Expense

4.56

4.40

4.30

4.36

4.38

4.29

4.38

4.46

4.49

|

|

NET INTEREST INCOME

2.71

2.81

2.88

2.84

2.85

2.93

2.87

2.84

2.85

|

| Loss Provisions-Interest Bearing Assets

0.27

0.24

0.23

0.27

0.37

0.25

0.26

0.26

0.26

|

| Noninterest Income

0.68

0.97

0.88

0.84

0.92

0.88

0.90

0.81

1.12

|

|

Mortgage Loan Servicing Fees

0.09

0.11

0.12

0.12

0.12

0.12

0.11

0.11

0.12

|

|

Other Fees and Charges

0.29

0.31

0.36

0.37

0.39

0.42

0.43

0.48

0.51

|

|

Other Noninterest Income

0.30

0.55

0.40

0.34

0.41

0.34

0.35

0.22

0.49

|

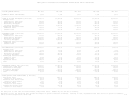

| Noninterest Expense

2.14

2.12

2.18

3.77

2.29

2.13

2.12

2.27

2.30

|

|

G&A Expense

2.01

2.02

2.08

3.69

2.20

2.05

2.02

2.18

2.19

|

|

Goodwill Amortization

0.10

0.07

0.08

0.07

0.07

0.07

0.07

0.07

0.08

|

|

Loss Provisions-Noninterest Bearing Assets

0.03

0.03

0.02

0.01

0.03

0.02

0.03

0.02

0.03

|

| Income Before Taxes & Extraordinary Items

0.99

1.43

1.35

-0.36

1.11

1.42

1.38

1.12

1.40

|

| Income Taxes

0.29

0.47

0.34

-0.24

0.34

0.51

0.49

0.41

0.51

|

| Extraordinary Items

-0.04

0.00

0.00

-0.13

0.00

0.00

0.00

0.00

0.00

|

|

NET INCOME

0.66

0.96

1.01

-0.25

0.77

0.91

0.89

0.71

0.89

|

|___________________________________________________________________________________________________________________________________________________________________________|

|

|

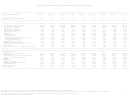

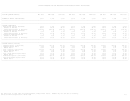

| PROFITABILITY (Percent)

|

|

Return on Average Assets (Annualized)

0.66

0.96

1.01

-0.25

0.77

0.91

0.89

0.71

0.89

|

|

Median Ratio

0.73

0.76

0.80

-0.52

0.83

0.87

0.89

0.87

0.79

|

|

Return on Average Equity (Annualized)

8.31

11.96

12.52

-3.16

9.75

11.47

11.09

8.73

10.74

|

|

Median Ratio

7.28

7.61

7.98

-5.10

8.48

8.87

8.74

8.63

7.70

|

|

Net Interest Margin (Annualized)

2.71

2.81

2.88

2.84

2.85

2.93

2.87

2.84

2.85

|

|

Median Ratio

3.10

3.11

3.19

3.21

3.21

3.22

3.25

3.22

3.18

|

|

Number of Profitable Thrifts

1,304

1,326

1,325

303

1,235

1,234

1,216

1,169

1,111

|

|

Percent Profitable

90.74

93.64

94.85

21.99

92.58

94.85

95.60

94.43

91.44

|

|

Profits ($ Millions)

$1,537.07

$1,889.35

$2,005.63

$369.93

$1,650.07

$1,775.15

$1,760.49

$1,656.50

$1,811.03

|

|

Number of Unprofitable Thrifts

133

90

72

1,075

99

67

56

69

104

|

|

Percent Unprofitable

9.26

6.36

5.15

78.01

7.42

5.15

4.40

5.57

8.56

|

|

Losses ($ Millions)

($274.38)

($61.98)

($78.55)

($852.87)

($181.82)

($49.67)

($73.90)

($314.56)

($112.91) |

|___________________________________________________________________________________________________________________________________________________________________________|

One thrift did not report financial data and one thrift was not required to report for March 1997.

Net income for the third quarter 1996 was significantly reduced by a one-time special assessment fee levied to fully capitalize the SAIF.

See Technical Notes for details.

All data exclude self-liquidating thrifts.

See Technical Notes for details.

All data prior to June 1996 are unconsolidated, except where noted.

Numbers may not sum due to rounding.

Office of Thrift Supervision / March 1998

T-3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30