Profitability For Ots-Regulated Private-Sector Thrift Institutions Guide - Office Of Thrift Supervision - U.s. Department Of Treasury - 1998 Page 28

ADVERTISEMENT

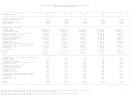

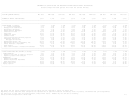

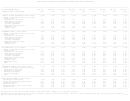

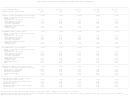

ASSET QUALITY INDICATORS FOR OTS-REGULATED PRIVATE-SECTOR THRIFT INSTITUTIONS

___________________________________________________________________________________________________________________________________________________________________________

|

|

| FOR THE QUARTER ENDING:

DEC 1993

DEC 1994

DEC 1995

DEC 1996

DEC 1997

|

|

|

| NUMBER OF THRIFT INSTITUTIONS:

1,669

1,543

1,437

1,334

1,215

|

|___________________________________________________________________________________________________________________________________________________________________________|

|

|

| LOANS 30-89 DAYS DELINQUENT (% Total Assets)

0.96%

0.82%

0.89%

0.88%

0.81%

|

|

Percent of Outstanding Loans by Loan Type:

|

|

Mortgage Loans

|

|

Construction & Land Loans

1.46

1.07

1.17

1.11

1.48

|

|

Nonresidential Mortgages

1.74

1.33

1.10

1.15

1.10

|

|

Multifamily Mortgages

1.14

0.90

0.84

0.58

0.40

|

|

1-4 Family Mortgages

1.48

1.28

1.40

1.29

1.13

|

|

Nonmortgage Loans and Leases

|

|

Commercial Loans

2.13

1.39

1.37

1.31

1.43

|

|

Consumer Loans

1.60

1.48

1.78

2.00

2.10

|

|___________________________________________________________________________________________________________________________________________________________________________|

|

|

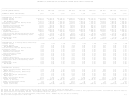

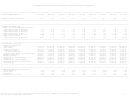

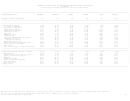

| NONCURRENT LOANS (% Total Assets)

1.28%

0.91%

0.88%

0.85%

0.77%

|

|

Percent of Outstanding Loans by Loan Type:

|

|

Mortgage Loans

|

|

Construction & Land Loans

3.77

1.75

1.33

0.92

1.23

|

|

Nonresidential Mortgages

4.08

2.81

2.03

1.69

1.62

|

|

Multifamily Mortgages

3.43

2.17

1.62

1.45

0.79

|

|

1-4 Family Mortgages

1.50

1.18

1.28

1.21

1.11

|

|

Nonmortgage Loans and Leases

|

|

Commercial Loans

4.49

2.55

1.43

1.38

1.10

|

|

Consumer Loans

0.90

0.72

0.76

0.89

0.97

|

|___________________________________________________________________________________________________________________________________________________________________________|

|

|

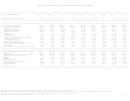

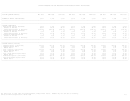

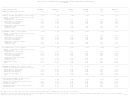

| NET CHARGE-OFFS (% Total Assets)

0.16%

0.12%

0.07%

0.08%

0.06%

|

|

Percent of Outstanding Loans by Loan Type:

|

|

Mortgage Loans

|

|

Construction & Land Loans

0.11

0.14

0.08

0.03

0.06

|

|

Nonresidential Mortgages

0.74

0.22

0.09

0.09

-0.04

|

|

Multifamily Mortgages

0.24

0.37

0.16

0.10

0.01

|

|

1-4 Family Mortgages

0.08

0.06

0.05

0.06

0.03

|

|

Nonmortgage Loans and Leases

|

|

Commercial Loans

0.81

0.09

0.19

0.11

0.13

|

|

Consumer Loans

0.30

0.24

0.29

0.39

0.50

|

|

Repossessed Assets

5.59

4.94

4.57

3.31

2.38

|

|

Other

0.10

0.53

0.11

0.15

0.25

|

|___________________________________________________________________________________________________________________________________________________________________________|

|

|

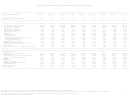

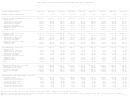

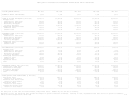

| REPOSSESSED ASSETS, NET (% Total Assets)

0.80%

0.44%

0.33%

0.28%

0.23%

|

|

Percent of Outstanding Loans by Loan Type:

|

|

Construction & Land Loans

11.23

5.48

2.83

1.93

1.30

|

|

Nonresidential Mortgages

4.58

2.78

1.47

1.12

0.86

|

|

Multifamily Mortgages

2.05

1.12

1.04

0.56

0.50

|

|

1-4 Family Mortgages

0.59

0.36

0.34

0.32

0.27

|

|

Other

0.16

0.08

0.10

0.20

0.19

|

|___________________________________________________________________________________________________________________________________________________________________________|

|

|

| ASSET QUALITY SUMMARY (% Total Assets)

|

|

Net Chargeoffs (Annualized)

0.64%

0.47%

0.30%

0.31%

0.24%

|

|

Net Provisions for Losses (Annualized)

0.42

0.26

0.27

0.37

0.26

|

|

Valuation Allowances

1.01

0.84

0.77

0.78

0.78

|

|

Noncurrent Loans

1.28

0.91

0.88

0.85

0.77

|

|

Repossessed Assets, Net (% Total Assets)

0.80

0.44

0.33

0.28

0.23

|

|

Troubled Assets

2.08

1.35

1.20

1.13

1.00

|

|___________________________________________________________________________________________________________________________________________________________________________|

All data prior to June 1996 are unconsolidated, except where noted.

Numbers may not sum due to rounding.

Beginning in 1997, net charge-off data include net changes in specific valuation allowances.

Starting in 1997, repossessed asset data are net of specific allowances.

Office of Thrift Supervision / March 1998

T-28

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30