Profitability For Ots-Regulated Private-Sector Thrift Institutions Guide - Office Of Thrift Supervision - U.s. Department Of Treasury - 1998 Page 6

ADVERTISEMENT

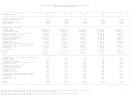

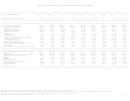

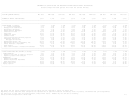

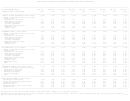

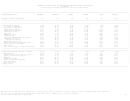

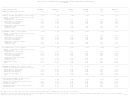

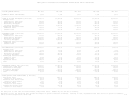

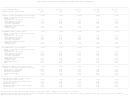

STATEMENT OF CONDITION FOR OTS-REGULATED PRIVATE-SECTOR THRIFT INSTITUTIONS

(Percent Change From Same Quarter Prior Year For Current Thrifts)

___________________________________________________________________________________________________________________________________________________________________________

|

|

| FOR THE QUARTER ENDING:

DEC 1995

MAR 1996

JUN 1996

SEP 1996

DEC 1996

MAR 1997

JUN 1997

SEP 1997

DEC 1997

|

|

|

|

|

| NUMBER OF THRIFT INSTITUTIONS:

1,437

1,416

1,397

1,378

1,334

1,301

1,272

1,238

1,215

|

|___________________________________________________________________________________________________________________________________________________________________________|

___________________________________________________________________________________________________________________________________________________________________________

|

|

| TOTAL ASSETS (% Change)

5.85%

4.39%

3.94%

5.15%

4.68%

5.55%

7.17%

7.70%

9.22% |

|

1 - 4 Family Mortgages

7.13

6.02

7.05

8.29

9.80

9.85

10.28

10.53

10.00

|

|

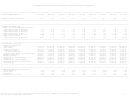

Mortgage Pool Securities

5.74

-0.60

-1.98

-2.15

-7.99

-4.04

-2.93

-0.98

1.86

|

|

Multifamily Mortgages

-1.95

-1.13

-1.73

-0.82

2.68

2.12

1.98

1.66

1.39

|

|

Nonresidential Mortgages

1.63

0.40

4.38

5.96

5.38

3.62

3.00

0.59

1.57

|

|

Construction Loans

15.78

22.70

27.47

30.73

28.47

-23.13

-26.39

-28.77

-29.63

|

|

Land Loans

12.37

17.61

22.92

20.19

17.90

0.82

-0.66

0.70

-1.51

|

|

Commercial Loans

47.43

31.41

37.21

36.97

36.96

23.52

31.63

31.64

35.12

|

|

Consumer Loans

9.71

10.57

10.11

12.36

10.85

15.50

17.63

21.85

27.37

|

|

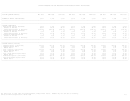

Cash and Noninterest-Earning Deposits

11.09

15.82

9.03

1.61

-3.24

-5.68

0.63

10.33

11.80

|

|

Investment Securities

0.22

0.52

-2.79

-0.94

-2.73

-4.41

-0.46

-3.44

3.86

|

|

Mortgage Derivatives

0.52

3.82

-4.08

-4.26

-7.43

-6.61

-5.57

-4.02

-1.40

|

|

Repossessed Assets, Net

-20.66

-16.43

-9.29

-11.03

-12.35

-13.98

-16.46

-11.82

-10.49

|

|

Real Estate Held for Investment, Net

-49.15

-31.17

217.83

244.31

238.04

260.77

-3.73

-4.55

3.16

|

|

Office Premises & Equipment

6.60

4.13

6.72

9.17

6.81

7.46

5.18

5.72

6.51

|

|

Other Assets

-20.63

-21.20

-27.22

-24.90

-24.15

-26.58

-18.50

-16.53

-12.06

|

|

Less: Contra Assets & Valuation Allowances

-1.70

2.62

12.97

15.71

18.65

-62.03

-64.86

-64.89

-63.13

|

|___________________________________________________________________________________________________________________________________________________________________________|

___________________________________________________________________________________________________________________________________________________________________________

|

|

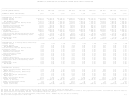

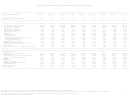

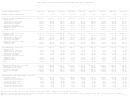

| TOTAL LIABILITIES AND CAPITAL (% Change)

5.85%

4.39%

3.94%

5.15%

4.68%

5.55%

7.17%

7.70%

9.22% |

|

TOTAL DEPOSITS

3.47

1.51

0.30

2.15

2.39

3.58

4.69

5.07

5.80

|

|

Deposits less than or equal to $100,000

1.86

0.03

-0.82

1.26

1.02

2.13

2.83

2.61

3.19

|

|

Deposits greater than $100,000

15.24

13.06

8.63

8.51

12.04

13.46

17.21

21.13

21.91

|

|

BORROWINGS

10.07

10.64

14.99

13.66

12.58

12.34

12.96

13.49

14.84

|

|

Advances From FHLB

4.16

13.16

24.51

29.16

26.66

20.39

24.05

23.08

25.77

|

|

Reverse Repurchase Agreements

12.89

1.29

-4.87

-13.64

-7.48

3.23

-4.65

0.68

0.23

|

|

Other Borrowings

26.00

18.20

24.50

22.59

2.67

2.35

6.13

3.77

-1.66

|

|

Other Liabilities

22.66

22.56

-43.11

-33.24

-39.50

10.44

23.86

9.67

36.80

|

|

Equity Capital

13.40

10.99

9.19

4.79

3.85

3.94

8.46

13.13

15.46

|

|___________________________________________________________________________________________________________________________________________________________________________|

One thrift did not report financial data and one thrift was not required to report for March 1997.

Beginning in 1997, detailed asset categories are reported net of specific valuation allowances, loans in process, and unamortized yield adjustments.

All data prior to June 1996 are unconsolidated, except where noted.

Numbers may not sum due to rounding.

Office of Thrift Supervision / March 1998

T-6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30