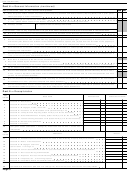

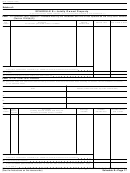

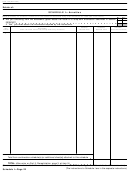

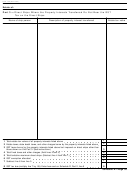

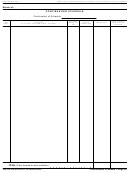

Form 706 - United States Estate (And Generation-Skipping Transfer) Tax Return Page 20

ADVERTISEMENT

Form 706 (Rev. 8-93)

Instructions for Schedule F.—Other

Household goods and personal effects, including

wearing apparel

Miscellaneous Property

Farm products and growing crops

You must complete Schedule F and file it with the

Livestock

return.

Farm machinery

On Schedule F list all items that must be included in

Automobiles

the gross estate that are not reported on any other

schedule, including:

If the decedent owned any interest in a partnership

or unincorporated business, attach a statement of

Debts due the decedent (other than notes and

assets and liabilities for the valuation date and for the

mortgages included on Schedule C)

5 years before the valuation date. Also attach

Interests in business

statements of the net earnings for the same 5 years.

Insurance on the life of another (obtain and attach

You must account for goodwill in the valuation. In

Form 712, Life Insurance Statement, for each

general, furnish the same information and follow the

policy)

methods used to value close corporations. See the

Note for single premium or paid-up policies: In

instructions for Schedule B.

certain situations, for example where the surrender

All partnership interests should be reported on

value of the policy exceeds its replacement cost, the

Schedule F unless the partnership interest, itself, is

true economic value of the policy will be greater

jointly owned. Jointly owned partnership interests

than the amount shown on line 56 of Form 712. In

should be reported on Schedule E.

these situations, you should report the full economic

If real estate is owned by the sole proprietorship, it

value of the policy on Schedule F. See Rev. Rul.

should be reported on Schedule F and not on

78-137, 1978-1 C.B. 280 for details.

Schedule A. Describe the real estate with the same

Section 2044 property

detail required for Schedule A.

Claims (including the value of the decedent’s

Line 1.—If the decedent owned at the date of death

interest in a claim for refund of income taxes or the

articles with artistic or intrinsic value (e.g., jewelry, furs,

amount of the refund actually received)

silverware, books, statuary, vases, oriental rugs, coin or

Rights

stamp collections), check the “Yes” box on line 1 and

provide full details. If any one article is valued at more

Royalties

than $3,000, or any collection of similar articles is

Leaseholds

valued at more than $10,000, attach an appraisal by

Judgments

an expert under oath and the required statement

Reversionary or remainder interests

regarding the appraiser’s qualifications (see

Regulations section 20.2031-6(b)).

Shares in trust funds (attach a copy of the trust

instrument)

Schedule F—Page 20

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41