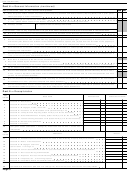

Form 706 - United States Estate (And Generation-Skipping Transfer) Tax Return Page 36

ADVERTISEMENT

Generation-Skipping Transfer Tax

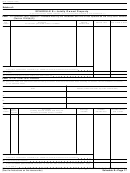

SCHEDULE R-1

(Form 706)

OMB No. 1545-0015

Direct Skips From a Trust

(August 1993)

Expires 12-31-95

Payment Voucher

Department of the Treasury

Internal Revenue Service

Executor: File one copy with Form 706 and send two copies to the fiduciary. Do not pay the tax shown. See the separate instructions.

Fiduciary: See instructions on following page. Pay the tax shown on line 6.

Name of trust

Trust’s EIN

Name and title of fiduciary

Name of decedent

Address of fiduciary (number and street)

Decedent’s SSN

Service Center where Form 706 was filed

City, state, and ZIP code

Name of executor

Address of executor (number and street)

City, state, and ZIP code

Filing due date of Schedule R, Form 706 (with extensions)

Date of decedent’s death

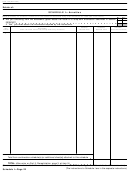

Part 1.—Computation of the GST Tax on the Direct Skip

Description of property interests subject to the direct skip

Estate tax value

1

1

Total estate tax value of all property interests listed above

2

2

Estate taxes, state death taxes, and other charges borne by the property interests listed above

3

3

Tentative maximum direct skip from trust. (Subtract line 2 from line 1.)

4

4

GST exemption allocated

5

5

Subtract line 4 from line 3

6

GST tax due from fiduciary. (Divide line 5 by 2.818182) (See instructions if property will not

bear the GST tax.)

6

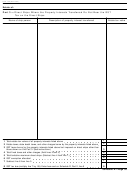

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief,

it is true, correct, and complete.

Signature(s) of executor(s)

Date

Date

Signature of fiduciary or officer representing fiduciary

Date

Schedule R-1 (Form 706)—Page 36

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41