Form 706 - United States Estate (And Generation-Skipping Transfer) Tax Return Page 22

ADVERTISEMENT

Form 706 (Rev. 8-93)

Estate of:

SCHEDULE I—Annuities

Note: Generally, no exclusion is allowed for the estates of decedents dying after December 31, 1984 (see instructions).

Yes

No

A

Are you excluding from the decedent’s gross estate the value of a lump-sum distribution described in section

2039(f)(2)?

If “Yes,” you must attach the information required by the instructions.

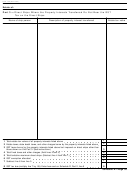

Alternate

Includible

Includible

Description

Item

valuation date

alternate value

value at date of death

Show the entire value of the annuity before any exclusions.

number

1

Total from continuation schedule(s) (or additional sheet(s)) attached to this schedule

TOTAL. (Also enter on Part 5, Recapitulation, page 3, at item 9.)

(If more space is needed, attach the continuation schedule from the end of this package or additional sheets of the same size.)

(The instructions to Schedule I are in the separate instructions.)

Schedule I—Page 22

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41