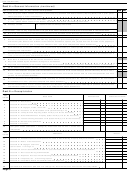

Form 706 - United States Estate (And Generation-Skipping Transfer) Tax Return Page 5

ADVERTISEMENT

Form 706 (Rev. 8-93)

Instructions for Schedule A—Real Estate

Enter the amount of the mortgage under

‘‘Description’’ on this schedule. The unpaid amount of

If the total gross estate contains any real estate, you

the mortgage may be deducted on Schedule K. If the

must complete Schedule A and file it with the return.

decedent’s estate is NOT liable for the amount of the

On Schedule A list real estate the decedent owned or

mortgage, report only the value of the equity of

had contracted to purchase. Number each parcel in

redemption (or value of the property less the

the left-hand column.

indebtedness) in the value column as part of the gross

estate. Do not enter any amount less than zero. Do not

Describe the real estate in enough detail so that the

deduct the amount of indebtedness on Schedule K.

IRS can easily locate it for inspection and valuation.

For each parcel of real estate, report the area and, if

Also list on Schedule A real property the decedent

the parcel is improved, describe the improvements. For

contracted to purchase. Report the full value of the

city or town property, report the street and number,

property and not the equity in the value column.

ward, subdivision, block and lot, etc. For rural property,

Deduct the unpaid part of the purchase price on

report the township, range, landmarks, etc.

Schedule K.

If any item of real estate is subject to a mortgage for

Report the value of real estate without reducing it for

which the decedent’s estate is liable, that is, if the

homestead or other exemption, or the value of dower,

indebtedness may be charged against other property

curtesy, or a statutory estate created instead of dower

of the estate that is not subject to that mortgage, or if

or curtesy.

the decedent was personally liable for that mortgage,

Explain how the reported values were determined

you must report the full value of the property in the

and attach copies of any appraisals.

value column.

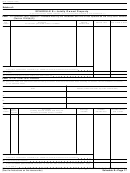

Schedule A Examples

In this example, the alternate valuation is not adopted; the date of death is January 1, 1993.

Item

Alternate

Alternate

Value at

Description

number

valuation date

value

date of death

1

House and lot, 1921 William Street NW, Washington, DC (lot 6, square 481). Rent

of $2,700 due at end of each quarter, February 1, May 1, August 1, and November

1. Value based on appraisal, copy of which is attached

108,000

Rent due on item 1 for quarter ending November 1, 1992, but not collected at date

of death

2,700

Rent accrued on item 1 for November and December 1992

1,800

2

House and lot, 304 Jefferson Street, Alexandria, VA (lot 18, square 40). Rent of $600

payable monthly. Value based on appraisal, copy of which is attached

96,000

Rent due on item 2 for December 1992, but not collected at date of death

600

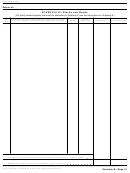

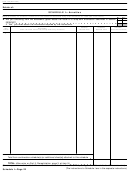

In this example, alternate valuation is adopted; the date of death is January 1, 1993.

Item

Alternate

Alternate

Value at

Description

number

valuation date

value

date of death

1

House and lot, 1921 William Street NW, Washington, DC (lot 6, square 481). Rent

of $2,700 due at end of each quarter, February 1, May 1, August 1, and November

1. Value based on appraisal, copy of which is attached. Not disposed of within 6

months following death

7/1/93

90,000

108,000

Rent due on item 1 for quarter ending November 1, 1992, but not collected until

February 1, 1993

2/1/93

2,700

2,700

Rent accrued on item 1 for November and December 1992, collected on February

1, 1993

2/1/93

1,800

1,800

2

House and lot, 304 Jefferson Street, Alexandria, VA (lot 18, square 40). Rent of $600

payable monthly. Value based on appraisal, copy of which is attached. Property

exchanged for farm on May 1, 1993

5/1/93

90,000

96,000

Rent due on item 2 for December 1992, but not collected until February 1, 1993

2/1/93

600

600

Schedule A—Page 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41