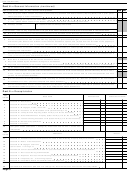

Form 706 - United States Estate (And Generation-Skipping Transfer) Tax Return Page 34

ADVERTISEMENT

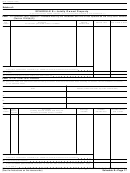

Form 706 (Rev. 8-93)

Estate of:

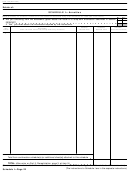

Part 2.—Direct Skips Where the Property Interests Transferred Bear the GST Tax on

the Direct Skips

Name of skip person

Description of property interest transferred

Estate tax value

1

1

Total estate tax values of all property interests listed above

2

2

Estate taxes, state death taxes, and other charges borne by the property interests listed above

3

GST taxes borne by the property interests listed above but imposed on direct skips other than

3

those shown on this Part 2. (See instructions.)

4

4

Total fixed taxes and other charges. (Add lines 2 and 3.)

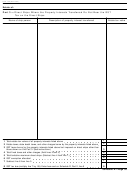

5

5

Total tentative maximum direct skips. (Subtract line 4 from line 1.)

6

6

GST exemption allocated

7

7

Subtract line 6 from line 5

8

8

GST tax due. (Divide line 7 by 2.818182)

9

9

Enter the amount from line 8 of Schedule R, Part 3

10

Total GST taxes payable by the estate. (Add lines 8 and 9.) Enter here and on line 22 of the Tax

Computation on page 1

10

Schedule R—Page 34

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41