Form 706 - United States Estate (And Generation-Skipping Transfer) Tax Return Page 26

ADVERTISEMENT

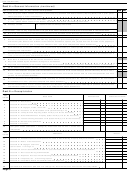

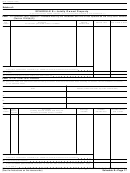

Form 706 (Rev. 8-93)

Estate of:

SCHEDULE L—Net Losses During Administration and

Expenses Incurred in Administering Property Not Subject to Claims

Net losses during administration

Item

Amount

number

(Note: Do not deduct losses claimed on a Federal income tax return.)

1

Total from continuation schedule(s) (or additional sheet(s)) attached to this schedule

TOTAL. (Also enter on Part 5, Recapitulation, page 3, at item 16.)

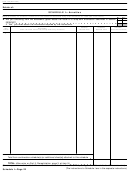

Item

Expenses incurred in administering property not subject to

Amount

number

claims (Indicate whether estimated, agreed upon, or paid.)

1

Total from continuation schedule(s) (or additional sheet(s)) attached to this schedule

TOTAL. (Also enter on Part 5, Recapitulation, page 3, at item 17.)

(If more space is needed, attach the continuation schedule from the end of this package or additional sheets of the same size.)

Schedule L —Page 26

(The instructions to Schedule L are in the separate instructions.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41