Form 706 - United States Estate (And Generation-Skipping Transfer) Tax Return Page 25

ADVERTISEMENT

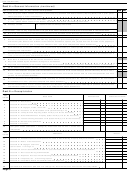

Form 706 (Rev. 8-93)

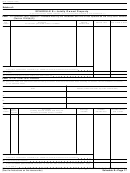

Estate of:

SCHEDULE K—Debts of the Decedent, and Mortgages and Liens

Item

Debts of the Decedent—Creditor and nature of claim, and

Amount claimed as

Amount unpaid to date

Amount in contest

number

allowable death taxes

a deduction

1

Total from continuation schedule(s) (or additional sheet(s)) attached to this schedule

TOTAL. (Also enter on Part 5, Recapitulation, page 3, at item 12.)

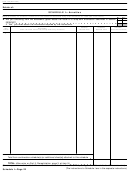

Item

Mortgages and Liens—Description

Amount

number

1

Total from continuation schedule(s) (or additional sheet(s)) attached to this schedule

TOTAL. (Also enter on Part 5, Recapitulation, page 3, at item 13.)

(If more space is needed, attach the continuation schedule from the end of this package or additional sheets of the same size.)

(The instructions to Schedule K are in the separate instructions.)

Schedule K —Page 25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41