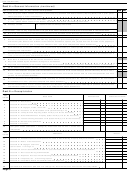

Form 706 - United States Estate (And Generation-Skipping Transfer) Tax Return Page 8

ADVERTISEMENT

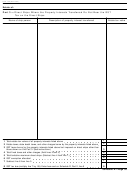

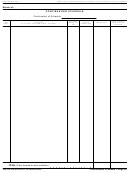

Form 706 (Rev. 8-93)

Decedent’s Social Security Number

Estate of:

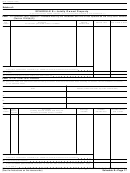

SCHEDULE A-1—Section 2032A Valuation

Part 1.—Type of Election (Before making an election, see the checklist on page 7.):

Protective election (Regulations section 20.2032A-8(b)).—Complete Part 2, line 1, and column A of lines 3 and 4. (See instructions.)

Regular election.—Complete all of Part 2 (including line 11, if applicable) and Part 3. (See instructions.)

Before completing Schedule A-1, see the checklist on page 7 for the information and documents that must be included to make

a valid election.

The election is not valid unless the agreement (i.e., Part 3-Agreement to Special Valuation Under Section 2032A)—

Is signed by each and every qualified heir with an interest in the specially valued property, and

Is attached to this return when it is filed.

Part 2.—Notice of Election (Regulations section 20.2032A-8(a)(3))

Note: All real property entered on lines 2 and 3 must also be entered on Schedules A, E, F, G, or H, as applicable.

1

Qualified use—check one

Farm used for farming, or

Trade or business other than farming

2

Real property used in a qualified use, passing to qualified heirs, and to be specially valued on this Form 706.

A

B

C

D

Schedule and item number

Full value

Adjusted value (with section

Value based on qualified use

from Form 706

(without section 2032A(b)(3)(B)

2032A(b)(3)(B)

(without section 2032A(b)(3)(B)

adjustment)

adjustment)

adjustment)

Totals

Attach a legal description of all property listed on line 2.

Attach copies of appraisals showing the column B values for all property listed on line 2.

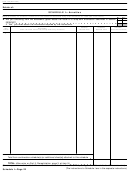

3

Real property used in a qualified use, passing to qualified heirs, but not specially valued on this Form 706.

A

B

C

D

Schedule and item number

Full value

Adjusted value (with section

Value based on qualified use

from Form 706

(without section 2032A(b)(3)(B)

2032A(b)(3)(B)

(without section 2032A(b)(3)(B)

adjustment)

adjustment)

adjustment)

Totals

If you checked “Regular election,” you must attach copies of appraisals showing the column B values for all property listed on line 3.

Schedule A-1—Page 8

(Continued on next page)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41