Instructions For Form 1 - Massachusetts Resident Income Tax - 2013 Page 10

ADVERTISEMENT

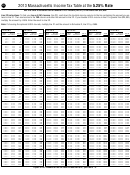

Schedule HC Worksheet for Line 11: Eligibility for Government-Subsidized Health Insurance

The following worksheet will determine if you were eligible for government-subsidized health insurance

in 2013. Complete the following worksheet only if an employer did not offer you affordable health in -

Table 2: Income at 300% of the

surance that met Minimum Creditable Coverage requirements, as determined in the Schedule HC

Worksheet for Line 10.

Federal Poverty Level

Note: If you answered Yes in line 6 of Schedule HC indicating that your income was at or below 150%

of the Federal Poverty Level or you had three or fewer blank ovals in a row during the period that the

Family size*

Income

mandate applied on line 7 of Schedule HC, the penalty does not apply to you. Do not complete this

work sheet. Skip the remainder of Schedule HC and continue completing your return.

01

$034,476

If married filing separately and living in the same household, each spouse must combine their income

02

$046,536

figures from their separate U.S. returns when com pleting this worksheet.

03

$058,596

1. Enter your income before adjustments (from U.S. Form 1040,

line 22, Form 1040A, line 15 or Form 1040EZ, line 4) . . . . . . . . . . . . 1

04

$070,656

2. Enter the amount from the Income column, based on your family

size (do not include dependent children age 19 or older in your

05

$082,716

family size), from Table 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

06

$094,776

If line 1 is greater than line 2: you were ineligible for government-subsidized health insurance in 2013

and must fill in the No oval(s) in line 11 of Sched ule HC, and go to Schedule HC Worksheet for Line 12

07

$106,836

to determine if you were deemed able to afford private health insurance.

08

$118,896

If line 1 is less than or equal to line 2, and at any point during the period when you were

uninsured: you were not a citizen or an alien legally residing in the U.S., or an employer offered

09

$130,956

to pay more than 20% of a family plan or 33% of an individual plan (the employer’s Human

Resources Department should be able to provide this information to you), or you applied for

10

$143,016

Mass Health or Commonwealth Care and were denied because you were ineligible for services,

you are deemed ineligible for government-subsidized health insurance in 2013. Fill in the

11

$155,076

No oval(s) in line 11 of Schedule HC, and go to Schedule HC Worksheet for Line 12 to determine

12

$167,136

if you were able to afford private health insurance.

If line 1 is less than or equal to line 2, and none of the above conditions apply, you would have

13

$179,196

been deemed eligible for government-subsidized health insurance in 2013, which you did not obtain

*Include only yourself, your spouse (if married

and you are subject to a penalty. Fill in the Yes oval(s) in line 11 of Schedule HC and go to the Health

Care Penalty Worksheet on page HC-11. Note: If you believe that, during the period when you were

filing a joint return) and any dependent chil dren

uninsured, your income was actually too high to qualify for government-subsidized insurance, you may

age 18 or younger in your family size. For fam-

have grounds to appeal the penalty. Fill in the Yes oval(s) in line 11 of Schedule HC and go to the

ily size over 13, add $12,060 for each addi tional

instruc tions for the Appeals section.

family member.

HC-8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44