Instructions For Form 1 - Massachusetts Resident Income Tax - 2013 Page 44

ADVERTISEMENT

PRSRT STD

U.S. POSTAGE

Massachusetts

PAID

Department of

COMMONWEALTH OF

MASSACHUSETTS

Revenue

PO Box 7011

Boston, MA 02204

Don’t use this form!

WebFile or E-File instead.

Contents

Health Care Information

HC-1

Minimum Creditable Coverage

HC-1

Schedule HC Instructions

HC-2

Schedule HC Worksheets & Tables

HC-6

Before You Begin

3

File

Web

Major Tax Changes for 2013

3

Filing Your Massachusetts Return

5

for

Income

When to File Your Return

6

Line by Line Instructions

7

It’s simple … and secure!

Name and Address

7

Filing Status

8

Exemptions

8

• File tax returns

5.25% Income

9

• Pay taxes

Deductions

10

5.25% Tax

11

• Amend tax returns

12% Income & Tax

11

• Appeal tax or penalties

Tax on Long-Term Capital Gains

12

• File an extension

Massachusetts Adjusted Gross Income

12

Amount of Your Refund

15

• Check refund status

Amount of Tax Due

15

Sign Here

16

Schedule Instructions

17

Schedule DI. Dependent Information

17

Schedule X. Other Income

17

Schedule Y. Other Deductions

18

Schedule Z. Credits

20

Schedule RF. Refundable Credits

22

Schedule B. Interest, Dividends & Certain Capital Gains 22

Schedule D. Capital Gains and Losses

25

Schedule C, Profit or Loss from Business

27

Schedule CB, Senior Circuit Breaker Credit

28

Visit us online at mass.gov/webfile

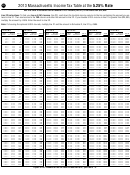

Tax Table at 5.25% Rate ($0–$24,000)

30

Resources

inside back cover

96M 12/13 2014JMBPRINTOFF33014

partially printed on recycled paper

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44