Instructions For Form 1 - Massachusetts Resident Income Tax - 2013 Page 9

ADVERTISEMENT

Schedule HC Worksheet for Line 10: Eligibility for Employer-Sponsored Insurance That Met Minimum

Creditable Coverage

The following worksheet will determine if you could have afforded employer-sponsored health insurance that met Minimum Creditable Coverage in 2013

(the employer’s Human Resources Department should be able to provide this information to you). Complete only if you (and/or your spouse if married filing

jointly) were eligible for insurance that met Minimum Creditable Coverage offered by an employer for the entire period you were uninsured in 2013 that

covered you, and your spouse and dependent children, if any. If an employer did not offer health insurance that met Minimum Creditable Coverage that

covered you, and your spouse and dependent children, if any, or if you were not eligible for insurance that met Minimum Creditable Coverage offered by

an employer, you were self-employed or you were unemployed, fill in the No oval(s) in line 10 of Schedule HC and complete the Schedule HC Worksheet

for Line 11 on page HC-8.

Note: If you answered Yes in line 6 of Schedule HC indicating that your income was at or below 150% of the Federal Poverty Level or you had three or

fewer blank ovals in a row during the period that the mandate applied on line 7 of Schedule HC, the penalty does not apply to you. Do not complete this

worksheet. Skip the remainder of Schedule HC and continue completing your return. Be sure to enclose Schedule HC with your return. If an employer of-

fered you free health insurance coverage in 2013 that met Minimum Creditable Coverage (the employer’s Human Resources Department should be able to

provide this information to you), you are deemed able to afford health insurance and are subject to a penalty. Fill in the Yes oval(s) in line 10 of Schedule HC

and go to the Health Care Penalty Worksheet on page HC-11.

1. Enter your federal adjusted gross income from U.S. Form 1040, line 37; Form 1040A, line 21; or 1040EZ, line 4 . . . . . . . . . 1

If line 1 is less than or equal to: $17,244 if single or married filing separately with no dependents; $23,268 if married filing jointly with no dependents or

head of household/married filing separately with one dependent; or $29,304 if married filing jointly with one or more dependents or head of household/

married filing separately with two or more dependents, you are deemed unable to afford employer-sponsored health insurance that met Minimum Creditable

Coverage requiring an employee contribution. Fill in the No oval(s) in line 10 of Schedule HC. Skip the remainder of this worksheet and go to the Schedule

HC Worksheet for Line 11 on page HC-8.

If line 1 is more than: $17,244 if single or married filing separately with no dependents; $23,268 if married filing jointly with no dependents or head of house -

hold/married filing separately with one dependent; or $29,304 if married filing jointly with one or more dependents or head of household/married filing sepa-

rately with two or more dependents, go to line 2.

2. Enter the lowest monthly premium cost of health insurance that would cover you, and your spouse and dependent children,

if any, offered to you during your uninsured period in 2013 through an employer. The employer’s Human Resources Depart-

ment should be able to provide this amount to you. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Note: If you declined employer-sponsored health insurance that met Minimum Creditable Coverage, the monthly premium amount may be found on the

Health Insurance Responsibility Disclosure Form (HIRD) you should have received from your employer.

If line 1 is more than: $17,244 but less than or equal to $56,273 if single or married filing separately with no dependents; $23,268 but less than or equal to

$89,032 if married filing jointly with no dependents or head of household/married filing separately with one dependent; or $29,304 but less than or equal to

$119,270 if married filing jointly with one or more dependents or head of household/married filing separately with two or more dependents, go to line 3.

If line 1 is more than: $56,273 if single or married filing separately with no dependents; $89,032 if married filing jointly with no dependents or head of house -

hold/married filing separately with one dependent; or $119,270 if married filing jointly with one or more dependents or head of household/married filing sep-

arately with two or more dependents, skip line 3 and go to line 4.

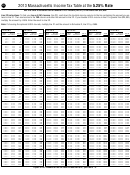

3. Enter the monthly premium that corresponds with your income range (from line 1 of worksheet) and filing status from Table 3:

Affordability on page HC-10. To find this amount, look at the row for your income range in col. a of the appropriate table based

on your filing status and go to col. b to find the monthly premium amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

If line 2 is less than or equal to line 3: you are deemed able to afford employer-sponsored health insurance that met Minimum Creditable Coverage dur-

ing your uninsured period(s), which you did not obtain, and you are subject to a penalty. Fill in the Yes oval(s) in line 10 of Schedule HC, and go to the Health

Care Penalty Worksheet on page HC-11.

If line 2 is greater than line 3: you could not afford health insurance that met Minimum Creditable Coverage offered to you by your employer, fill in the No

oval(s) in line 10 of Schedule HC, and complete the following Schedule HC Worksheet for Line 11 on page HC-8.

4. Divide line 1 by 120. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

If line 2 is less than or equal to line 4: you are deemed able to afford employer-sponsored health insurance that met Minimum Creditable Coverage dur-

ing your uninsured period(s), which you did not obtain, and you are subject to a penalty. Fill in the Yes oval(s) in line 10 of Schedule HC, and go to the Health

Care Penalty Worksheet on page HC-11.

If line 2 is greater than line 4: you could not afford health insurance that met Minimum Creditable Coverage offered to you by your employer, fill in the No

oval(s) in line 10 of Schedule HC, and complete the following Schedule HC Worksheet for Line 11 on page HC-8.

HC-7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44