Instructions For Form 1 - Massachusetts Resident Income Tax - 2013 Page 8

ADVERTISEMENT

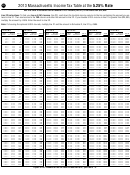

Schedule HC Worksheets and Tables

Following are the necessary worksheets you may need to complete your 2013 Schedule HC. Retain these worksheets for your records. Do not

submit these with your tax return.

Schedule HC Worksheet for Line 6: Federal Poverty Level

1. Enter your federal adjusted gross income from Schedule HC, line 2 1

Table 1: Federal Poverty Level,

2. Enter the income amount that corresponds to your family size (as

Annual Income Standards

entered on Schedule HC, line 1c) from the 150% FPL column from

Table 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Family size*

150% FPL

If line 1 is less than or equal to line 2, your income in 2013 was at or below 150% of the Federal Pov erty

Level and the penalty does not apply to you in 2013. Fill in the Yes oval in line 6 of Schedule HC, skip

1

$17,244

the re mainder of Schedule HC and continue completing your tax return.

2

$23,268

If line 1 is greater than line 2, your income in 2013 was above 150% of the Federal Poverty Level. Fill

in the No oval in line 6 of Schedule HC and go to line 7 of Schedule HC.

3

$29,304

4

$35,328

5

$41,364

6

$47,388

7

$53,424

8

$59,448

additional

+ $ 6,036

*This schedule reflects the Federal Poverty

Level standards for 2013.

HC-6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44