Instructions For Form 1 - Massachusetts Resident Income Tax - 2013 Page 24

ADVERTISEMENT

12

2013 Form 1 — Line by Line Instructions

Tax on Long-Term

for actual use must be added back to your tax on

3. Enter amount from Form 1,

Form 1. Complete and enclose Schedule H-2,

line 17 . . . . . . . . . . . . . . . . . . . . . . .

Credit Recapture and fill in the appropriate oval(s)

Capital Gains

4. Subtract line 3 from line 2. If “0” or less,

on line 25. Schedule H-2 is available at www.

you do not qualify for this exemption.

mass.gov/dor or by calling (617) 887-MDOR or

Omit remainder of worksheet . . . . .

Line 24. Schedule D

(Long-Term

toll-free in Massachusetts 1-800-392-6089.

5. Excess exemptions applied against interest

Capital Gains and Losses Excluding

and dividend income and 12% income. If line 1

Line 26. Additional Tax on

Collectibles)

is larger than line 4, enter line 4 here and in

Installment Sale

Enter in line 24 the amount from Schedule D, line

Schedule B, line 36. If line 4 is equal to or

An addition to tax applies for taxpayers who have

larger than line 1, enter line 1 here and in

22, but not less than “0.” To determine if you need

deferred the gain, and the tax associated with that

Schedule B, line 36. Complete lines

to file Schedule D, refer to the Schedule D instruc -

6 through 8 . . . . . . . . . . . . . . . . . . .

gain, on certain installment sales. This addition to

tions in this booklet.

6. Subtract line 5 from line 4. If “0,”

tax is measured by an interest charge on the tax

omit remainder of worksheet . . . . .

Schedule B, Line 36 and Schedule D, Line 20

that has been deferred.

7. Enter Schedule D, line 19. Not less

Worksheet. Excess Exemptions from Interest

Include in line 26 an additional tax amount repre-

than “0” . . . . . . . . . . . . . . . . . . . . . .

and Dividend Income, 12% Income and Long-

senting an interest charge on the deferred tax on

8. Excess exemptions applied against long-term

Term Capital Gain Income (Only if Single,

gain from certain installment sales with a sales

capital gain income. If line 7 is larger than line 6,

Head of Household, or Married Filing Jointly)

price over $150,000 if you are not a dealer and the

enter line 6 here and in Schedule D, line 20.

If your total exemptions in Form 1, line 18 are

aggregate face amount of installment obligations

If line 6 is equal to or larger than line 7,

more than the amount of your 5.25% income

arising during the tax year and outstanding as of

enter line 7 here and in Schedule D,

after deductions in Form 1, line 17, the excess

the close of the tax year exceeds $5 million. For

line 20 . . . . . . . . . . . . . . . . . . . . . . .

may be applied against any interest and divi -

more information see G.L. c. 62C, sec. 32A (a) and

dend income and income taxed at 12%. Any

Excess Exemptions

I.R.C. sec. 453A (a)–(c).

remaining excess amount may then be applied

If excess exemptions were used in calculating lines

Also include in line 26 an additional tax amount

against any long-term capital gain income.

20, 23 or 24 (see Schedule B, line 36 and/or Sched -

representing an interest charge on the deferred

Complete this worksheet only if Form 1, line 17

ule D, line 20), be sure to fill in the oval in line 24.

gain from the installment sale of timeshares and

is less than Form 1, line 18 and you received

residential lots, if the sale meets one of the follow-

interest income (other than interest from Mass -

Line 25. Credit Recapture Amount

achu setts banks), dividends or capital gain

ing criteria: 1) the sale is of a timeshare right for 6

If any Brownfields Credit (BC), Economic Opportu-

income to determine if you qualify for the

weeks or less; 2) the sale is for the recreational

nity Area Credit (EOA), Low Income Housing Credit

excess exemption. Enter all losses as “0.”

use of specified campgrounds; or 3) the sale is for

(LIH) or Historic Rehabilitation Credit (HR) prop-

a residential lot and neither the dealer nor some-

1. Enter amount from Schedule B,

erty is disposed of or ceases to be in qualified use

one related to the dealer is obligated to make any

line 35. Not less than “0” . . . . . . . .

prior to the end of its useful life, the difference be-

improvements on the lot. For more information

2. Enter amount from Form 1,

tween the credit taken and the total credit allowed

see G.L. c. 62C, sec. 32A (b) and I.R.C. sec.

line 18 . . . . . . . . . . . . . . . . . . . . . . .

453(l)(2)(B).

If you are a partner in a partnership or a share-

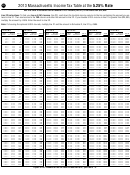

No Tax Status/Limited Income Credit Chart

holder in an S corporation, the entity is required to

Filing status:

send you the information you need to calculate the

Number of dependents

Head of household. Line 7 of

Married filing a joint return.

addition to tax under this provision.

(from Form 1, line 2b):

the AGI worksheet is less than

Line 7 of the AGI worksheet

To the extent practicable, Massachusetts follows

or equal to:

is less than or equal to:

federal income tax rules in determining the de-

0

$14,400

$25,200

$16,400

$28,700

ferred gain from installment sales subject to the

1

15,400

26,950

17,400

30,450

interest-charge addition to tax. For more informa-

16,400

28,700

18,400

2

32,200

tion visit DOR’s website at and

3

17,400

30,450

19,400

33,950

Internal Revenue Service Publication 537.

4

18,400

32,200

20,400

35,700

5

19,400

33,950

21,400

37,450

20,400

35,700

22,400

6

39,200

Massachusetts

you qualify for

you may qualify

you qualify for

you may qualify

No Tax Status

for the Limited

No Tax Status

for the Limited

Adjusted Gross

Income Credit

Income Credit

Income (AGI)

If the number of dependents is more than 6, add $1,000 per dependent to the No Tax Status column, or

$1,750 per dependent to the Limited Income Credit column.

If you qualify for No Tax Status, fill in the oval in line 27, enter “0” in line 28 and omit lines 29 and 30.

No Tax Status — Single, Married Filing a

Also, enter “0” in line 31 and complete Form 1. However, if there is an amount entered in line 25, Credit

Joint Return or Head of Household Only

Recapture Amount and/or line 26, Additional Tax on Installment Sales, enter that amount in line 28 and

If your Massachusetts AGI was $8,000 or less if

complete line 30. If you may qualify for the Limited Income Credit, go to line 28 and complete the

single, $14,400 or less plus $1,000 per depen-

worksheet for line 29.

dent if head of household, or $16,400 or less plus

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44