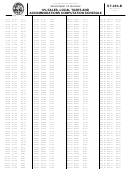

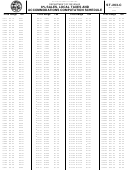

Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 14

ADVERTISEMENT

ESSENTIAL INFORMATION FOR FORM ST-388

(Rev. 12/5/13)

Please read carefully and keep this information in a convenient place for future reference.

WHO MUST FILE

Any person liable for sales tax on accommodations is required to file form

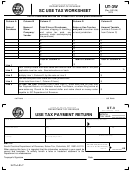

Form ST-3T: Accommodations Report by County or Municipality for

ST-388 to report any sales and use tax in this State. As a general rule, such

Sales and Use Tax: This form is used for reporting accommodations tax by

person is required to obtain a retail license from the South Carolina

counties or municipalities when taxpayer owns or manages rental units in

Department of Revenue (Department). However, a person furnishing

several counties or municipalities. A taxpayer who owns or manages rental

accommodations to transients for one week or less in any calendar quarter is

units in more than one county or municipality is required to report separately

not required to obtain a retail license, but must remit the tax annually by April

the total gross proceeds from business done in each county or municipality.

15th of the following calendar year. If you are licensed with the Department

The ST-3T must be submitted with the ST-388 even if you only have rental

for purposes of filing a return to remit sales tax on accommodations, you

units in the county/municipality where your business is located.

must file a return even if there is no tax due for the period. Enter zero “0” on

lines 1, 1A, 1B, and 3 of Column A, B and C only on the front of ST-388, if

ST-8A: Resale Certificate: The resale certificate form is used by retailers

you do not have sales and/or purchases to report for the period. For

(purchasers) to purchase tax-free at wholesale items that are to be resold.

information relating to a convenient and paperless method of filing certain

This certificate is extended by the purchaser to the seller who maintains the

returns via touchtone telephone (filing zero “0” returns), contact the

certificate on file as evidence that the sales transaction is not subject to the

Department by E-mail at or by telephone at (803)

tax. It is not required that the form ST-8A be used as long as the certificate

898-1715.

presented to the seller contains the purchaser's name, address, and retail

sales tax license number. Also, it is not necessary that a certificate be

WHEN TO FILE

extended each time a sale is made. A resale certificate should not be used

by a retailer to purchase products for their own use.

Sales and Use Tax returns are due on or before the twentieth (20th) day of

the month following the close of the period ended. Example:

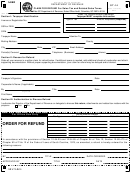

ST-14: Claim For Refund: If you have overpaid your sales/use tax on your

return, you should file a claim for refund in the form of a letter or by using the

Monthly filers: (Return must be received/postmarked by the 20th)

enclosed form ST-14, Claim for Refund, and file amended (corrected) figures

January reporting period - no later than February 20.

for the periods requested. Do not take a credit on the sales and use tax

February reporting period - no later than March 20.

return for any overpayments. The claim for refund should specify: the

March reporting period - no later than April 20, etc.

name, address, and telephone number of the taxpayer or contact person; the

December reporting period - no later than January 20 (of the next year).

appropriate taxpayer identification number(s); the tax period or date for

Note: To request a change in your filing status (monthly, quarterly, annual or

which the tax was paid; the nature and kind of tax paid; the amount which is

seasonal) a written request must be made to the South Carolina Department

claimed as erroneously paid; a statement of facts and documentation

supporting the refund position; a statement outlining the reasons for the

of Revenue. The request must be approved before a return and remittance

claim, including any law or other authority upon which you rely; and any

can be made for the filing status being requested.

other relevant information that the Department may reasonably require.

Quarterly Filers: (Return must be received/postmarked by the 20th)

C-278: Account Closing Form: When closing or selling your business, you

First Quarter (January, February, March) reporting period - no later than

are required by law to return your sales and use tax license to the

April 20.

Department of Revenue indicating the date of closing. Complete Form C-278

Second Quarter (April, May, June) reporting period - no later than July

when closing your business. You must file all returns and pay all taxes due.

20.

If you sell your business, the new owner will not be issued a new license

Third Quarter (July, August, September) reporting period - no later than

until taxes due for that location have been paid. A change in ownership will

October 20.

require the new owner to complete a form SCDOR-111, Tax Registration

Fourth Quarter (October, November, and December) reporting period -

Application, and remit the appropriate license tax. The SCDOR-111 is

no later than January 20 (of the next year).

available on our website at

Annual Filers: (Sales for the entire year)

December return must be received/postmarked no later than January 20 (of

SC8822: Change of Name/Address/Business Location: Any change of

the next year).

location requires that written notification be sent to the Department of

Revenue by submitting form SC8822.

Seasonal Filers: Seasonal filers are required to file returns only for those

months scheduled to be reported. Returns must be received/postmarked no

Change in Ownership: Any change in ownership will require a new owner

later than the 20th of the next month.

to complete a Business Tax Application, Form SCDOR-111 and remit the

appropriate license fee. The SCDOR-111 is available on our website at

FILING STATE AND LOCAL OPTION

However, if you would like to obtain a license online (via the

internet), go to SC Business One Stop, SC’s Business Portal:

SALES AND USE TAX FORMS

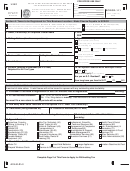

ST-388: State Sales, Use and Accommodation Tax Return: This form is

Filing an Amended Sales and Use Tax Return: Instructions for filing an

to be used by any person in the business of furnishing accommodations,

amended State and Local Sales and Use Return for South Carolina are as

whether such person is the owner or a real estate agent, listing service,

follows:

broker,

online

travel

company,

or

similar

entity

handling

the

accommodations. It is used for reporting the State Sales and Use tax on

Check the “Amended Return” box on the top of your State sales and

sales and purchases of tangible property, upon sales of accommodations

use tax return (e.g., ST-3, ST-388, ST-403 or ST-455). If there is no

and additional guest charges and local taxes imposed on such sales as

check box at the top of the return to indicate this is an amended return,

administered by the SC Department of Revenue.

be sure to write “Amended” at the top of the return. If your local sales

and use tax return (e.g., ST-389) will change, write “AMENDED”

A person liable for sales tax on accommodations is required to file form

across the top of the form.

ST-388 to report any sales and use tax in this State. As a general rule, the

When filing an amended return, be sure to complete your return as if it

person liable for the sales tax on accommodations is required to obtain a

were an original return. In other words, complete the amended return

retail license from the South Carolina Department of Revenue (Department).

as if you were filing it for the first time. DO NOT complete the amended

However, a person furnishing accommodations to transients for one week or

return with figures that represent the difference between the original

less in any calendar quarter is not required to obtain a retail license, but

amounts reported on the return and the amended amounts to be

must remit the sales tax annually by April 15th of the following year.

reported on a return.

If using a copy of the original return, draw a line through any incorrect

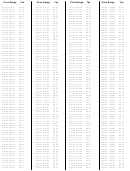

ST-389: Schedule for local Taxes: You are required to file form ST-389 to

or wrong amounts as they appear on the original return reported and

report the appropriate local sales and use tax to a county or municipality

write down the correct amounts as they should have appeared on the

based upon sales or deliveries within the county or municipality. You are

return.

required to file this form when:

If you filed an amended return on or by the due date of your original tax

(1) Your business is located in a county that imposes the tax or

return, or if you filed an amended return after the due date of an

originally filled return which was timely filed and paid, recalculating the

(2) Your business delivers to a county or municipality with local

taxpayer’s discount may be necessary.

tax regardless of whether your business is or is not located

If you underpaid your taxes when filing an amended return, verify your

in a county that imposes a local tax

computations of the underpayment amount and send the additional tax

due with applicable penalties and interest. Penalty and Interest

The various local taxes reportable on the ST-389 are indicated on specific

calculations are available on our website, under the link

pages of form ST-389. The ST-389 is not used to report local taxes on sales

P & I Calculator. If you overpaid your taxes, see Form ST-14 (Claim for

of accommodations or on sales of prepared meals that are collected directly

Refund) for additional information.

by the counties.

Sign and date the amended return.

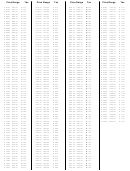

ST-389A: Local Option Addendum: Use this form if you need more space

All forms pertaining to sales and use tax may be found on our website or by

for reporting the local option tax located on page 6 of ST-389. You must

calling (800) 768-3676 or (803) 898-5788.

enter the applicable county/municipality code listed on the reverse side when

reporting the local option tax.

13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

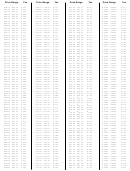

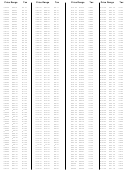

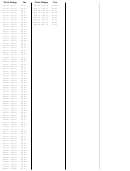

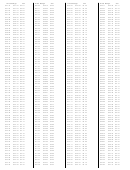

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86