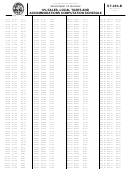

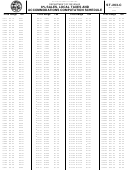

Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 7

ADVERTISEMENT

Taxpayers' Bill Of Rights

You have the right to apply for assistance from the Taxpayer Rights' Advocate within the Department of Revenue. The

advocate or his designee is responsible for facilitating resolution of taxpayer complaints and problems.

You have the right to request and receive forms, instructions and other written materials in plain, easy-to-understand

language.

You have the right to prompt, courteous service from us in all your dealings with the Department of Revenue.

You have the right to request and receive written information guides, which explain in simple and nontechnical language,

appeal procedures and your remedies as a taxpayer.

You have the right to receive notices which contain descriptions of the basis for and identification of amounts of any tax,

interest and penalties due.

Under the provisions of Section 12-4-340 of the 1976 code of laws, any outstanding liabilities due and owing to South Carolina

Department of Revenue for more than 6 months may be assigned to a private collection agency for collecting actions.

Collection Process

If your sales tax return is not postmarked by the 20th of the month following the close of the period, your return is considered

delinquent and will be charged with the appropriate penalties and interest.

If your return is not received:

The Department of Revenue will issue an estimated assessment. Contact the Department of Revenue or mail (includes Telefile

or eSales) your return when you receive the notice.

Ninety (90) days after receiving the estimated assessment, a tax lien may be recorded. The tax lien will adversely affect your

credit rating for 10 years. You may be unable to obtain credit or transfer property if a tax lien is filed against you. Contact the

Department of Revenue.

Failure to file and/or pay taxes can result in revocation of your licenses with the Department of Revenue.

You may be contacted by Department of Revenue personnel at any time during this process by phone or in person. Always ask

for proper identification before discussing your account.

Business Personal Property

All businesses are required to file a business personal property return (Form PT-100) with the Department of Revenue annually.

All furniture, fixtures and equipment are to be reported at acquisition cost with a deduction allowed for depreciation. The return is

due on the last day of the fourth month following the close of the tax year. There is no provision in the law for an extension.

For additional information pertaining to Business Personal Property call 803-898-5222.

PT-100 Electronic Filing Notice

The filing of Business Personal Property tax is made available electronically through South Carolina Business

One Stop (SCBOS) beginning for businesses with an account closing period of December 31, 2010. Starting

with businesses with an account closing period of December 31, 2010, DOR will no longer mail the pre-printed

PT-100.

For more information please visit the SCBOS Business Personal Property informational website at

https://

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

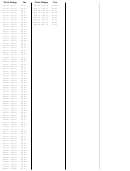

85 86

86