Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 16

ADVERTISEMENT

Examples of Allowable Deductions: (Not all inclusive)

Out-of-state sales

Food purchased with food stamps

Federal Government

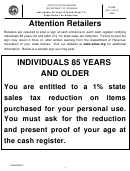

1% tax reduction for purchases made by individuals age 85 or

Sales for resale

older (1% tax reduction does not apply to local tax

Sales Tax Holiday exempt sales

calculations)

Unprepared food eligible to be purchased w/ USDA food coupon

(local tax applies if not specifically exempted by the local tax)

Note: Sales that are exempt from the state sales and use tax rate are generally exempt from the local tax rate. However, it is important

to note that certain amounts itemized as a state sales tax deduction (i.e., on Item 7) and subtracted on (i.e., Item 8) the state tax

worksheet (reverse side of ST-388) may be subject to a local tax since the local tax may not specifically provide such an exemption.

[For instance: 1% of the state sales tax and use rate for individuals age 85 and older is excluded from the state sales and use tax

calculations. Therefore, an amount which is equivalent to 1% of gross proceeds of sales to such an individual is allowed as a deduction

from gross proceeds of sales for state sales and use tax purposes. However, the total amount (gross proceeds of sale) of such a sale is

subject to all applicable local sales and use taxes since the local taxes have no such exemption.] See ST-389 instruction for additional

information if local taxes are applicable.

You are required to maintain records that will support all deductions claimed on this return. A further explanation of deductions is

available by obtaining a copy of the South Carolina Sales and Use Tax Code of Laws by contacting the Department’s Main

Office, the Taxpayer Service Centers or visit our website: and Policy

Item 8: Total Amount of Deductions

Enter total here and on line 2, Column A on front of ST-388.

Item 9: Net Taxable Sales and Purchases

(Item 6 minus Item 8. Enter total here and on line 3, Column A on front of ST-388.)

COMPLETING THE 5% SALES AND USE TAX WORKSHEET #3

STEP 3

Items 10 through 13

This section is used to report the total charges for rooms, lodging and accommodations subject to the State sales tax rate of

7%. The gross proceeds from charges for accommodations must be entered on Item 10 of Worksheet #3 (subject to 5% rate) and Item

14 of Worksheet #4 (subject to 2% rate) to properly report sales subject to the 7% State sales tax rate.

Item 10: Gross Proceeds of Sales, Accommodations/Rentals and Withdrawals of inventory for Own Use

Enter gross proceeds of sales (taxable and nontaxable), leases and/or rentals made by the business for the reporting period here and

on Line 1A, Column B on the front of ST-388.. DO NOT INCLUDE THE AMOUNT OF SALES TAX COLLECTED.

Item 11: Sales and Use Tax Allowable Deductions

To claim a deduction relating to sales, the sale transaction must be reported on Items 1 and 2 of Worksheet #1 and Item 10 of this

worksheet. Enter the type of deduction (see list below) and the dollar amount of the sale. A partial list of exemptions and exclusions

from sales and use tax are identified on instructions to Item 7 of Worksheet #2.

Examples of deductions for Accommodations Tax are listed below:

- Golf packages

- Meeting rooms (used by a person who is not a guest at the hotel)

- Some special promotion packages

Note: Remember that even though the transactions above are not subject to accommodations tax, they ARE subject to State Sales Tax

and Local Sales Taxes.

- Transient accommodations furnished to the same person for a period of ninety (90) or more consecutive days.

- Accommodations billed directly to the Federal Government.

Note: You are required to maintain records that will support all deductions claimed on this return. A further explanation of deductions

is available by obtaining a copy of the South Carolina Sales and Use Tax Code of Laws by contacting the Department's Main

Office, the Taxpayer Service Centers or visit our website:

Item 12: Total Amount of Deductions

Enter total here and on Iine 2, Column B on front of ST-388.

Item 13: Net Taxable Sales and Purchases

(Item 10 minus ltem 12 should agree with Line 3, Column B on front of ST-388.) Enter total here.

COMPLETING THE 2% ACCOMMODATIONS TAX WORKSHEET #4

STEP 4

Items 14 through 17

Item 14: Gross Proceeds of Sales from Rental of Transient Accommodations

Enter gross proceeds of sales from the rental of transient accommodations here and on Line 1B, Column C on the front of ST-388.

Item 15: Sales and Use Tax Allowable Deductions

Enter the type of transaction and the corresponding amount for the deduction.

Examples of deductions for Accommodations Tax are listed below:

- Golf packages

- Meeting rooms (used by a person who is not a guest at the hotel)

- Some special promotion packages

Note: Remember that even though the transactions above are not subject to accommodations tax, they ARE subject to State Sales

Tax and Local Sales Taxes.

- Transient accommodations furnished to the same person for a period of ninety (90) or more consecutive days.

- Accommodations billed directly to the Federal Government.

15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86