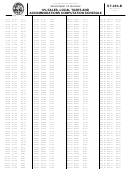

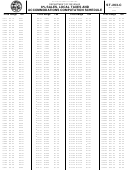

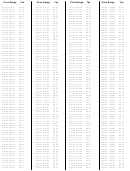

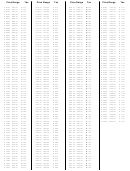

Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 83

ADVERTISEMENT

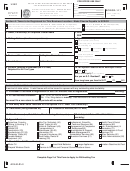

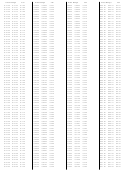

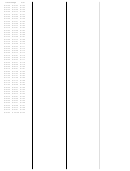

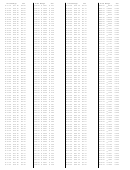

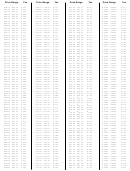

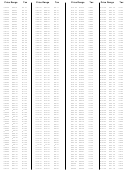

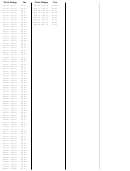

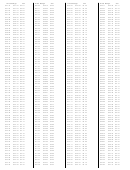

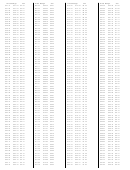

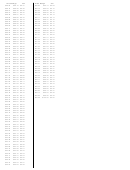

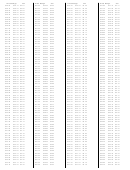

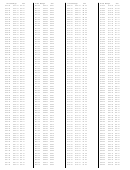

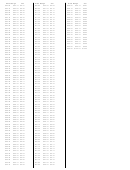

TAXPAYER RECORD

Lines 1 through 10

Jan

Feb

Mar

April

May

June

July

Aug

Sept

Oct

Nov

Dec

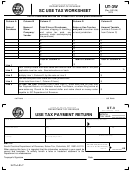

Form ST-388

Sales and Use Tax

1. Gross Proceeds of Sales

Line 1A: Column A (6% Rate)

Column B (5% Rate)

Line 1B: Column C (2% Rate)

2. Total Deductions

and Subtractions

Column A (6% Rate)

Column B (5% Rate)

Column C (2% Rate)

3. Net Taxable Sales

Column A (6% Rate)

Column B (5% Rate)

Column C (2% Rate)

4 Tax Due

Column A (6% Rate)

Column B (5% Rate)

Column C (2% Rate)

5. Taxpayer's Discount

Column A (6% Rate)

Column B (5% Rate)

Column C (2% Rate)

6. Balance Due

Column A (6% Rate)

Column B (5% Rate)

Column C (2% Rate)

7B. Total Penalty and Interest

Column A (6% Rate)

Column B (5% Rate)

Column C (2% Rate)

8A. Total Sales, Use and

Accomodations Due

9. Total Local Taxes Due

10. Total Amount Due

Reminder: Combined Discount cannot exceed $3000.00 per fiscal year, returns for June through May, which are filed July through June.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86