Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 19

ADVERTISEMENT

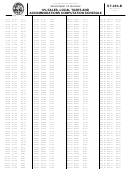

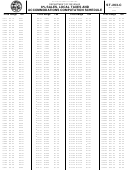

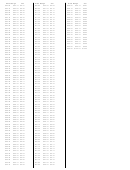

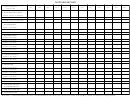

INSTRUCTIONS FOR FORM ST-3T

Please read instructions before completing Form ST-3T.

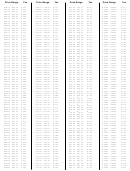

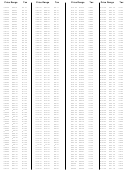

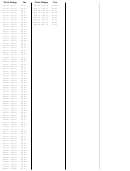

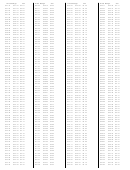

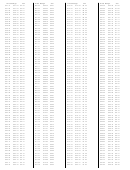

The ST-3T form is used to report the total gross proceeds derived from business done within and without the corporate

limits of the different municipalities within the state. Taxes must be reported by municipality code if location is within

incorporated area of a county or county code if not within an incorporated area.

When completing the Form ST-3T, all entries must be typed or hand printed, clearly and legibly.

Important: ST-3T must be submitted with Form ST-388.

Item 1: Print or type the present correct business name and mailing address.

Item 2: Enter the page number that corresponds with the number of pages of the ST-3T being submitted (e.g., 1 of 1, or 1

of 2, 2 of 2).

Item 3: Enter complete retail license number as shown on form ST-388 (retail license or use tax registration box).

Item 4: Enter the month and year of the period ended as shown on form ST-388.

Item 5: Print or type the name of the county or municipality in which the rental unit(s) is (are) located.

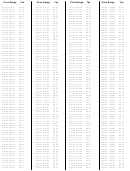

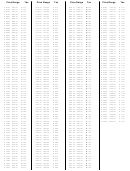

Item 6: Enter the location code shown on the reverse side associated with the county or municipality in which the rental

unit(s) is (are) located. If the business location is within a listed municipality, use the municipal code. If the business

location is NOT within a listed municipality, use the county numerical code.

Item 7: Enter gross proceeds of sales from business transacted in each county or municipality in Column 7 of the ST-3T.

The total of this column must equal the total shown on Line 1B Column C of form ST-388 for the period covered.

Item 8: Subtract non-taxable sales from business transacted in each county or municipality and enter net taxable sales in

Column 8 of ST-3T. The total of this column must equal the total shown on Line 3 Column C of form ST-388.

Item 9: Multiply net taxable sales from business transacted in each county or municipality by two percent (2%) tax rate.

Multiply the results by the discount rate used on line 5 of form ST-388 to compute discount amount claimed.

Item 10: Subtract discount amount from the two percent (2%) tax amount computed and enter the net amount payable

after discount under Column 9 for each county or municipality listed. The total of this column must equal the total shown

on Line 6 Column C of form ST-388.

Item 11: Total from Columns 7, 8, and 9 of ST-3T must equal the amount shown on Line 1B Column C, Line 3 Column C,

and Line 6 Column C respectively from the front of form ST-388.

Item 12: Attach this report to the sales, use, and accommodations tax return (ST-388) for the period covered.

REMINDER: All pages of Form ST-3T must be attached to the state Form ST-388. Make a copy of the completed Form

ST-3T for your records.

Mail To: South Carolina Department of Revenue, Sales & Use Tax, Columbia, South Carolina 29214-0101.

18

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86