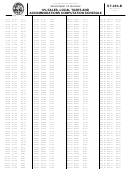

Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 15

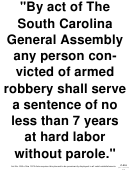

ADVERTISEMENT

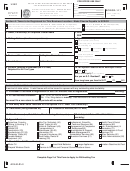

STEP-BY-STEP INSTRUCTIONS FOR ST-388

(Rev. 12/5/13)

5241

Please read this section before completing your form.

If you are using a blank form (non-preprinted) be sure to indicate the following information: Business Name, Address,

Retail License Number or Purchaser's Certificate (Use Tax Registration), Federal Employer Identification Number or other

identifying information (social security number) and period covered. Please draw a line through any incorrect information,

enter corrections and check the box on your return if your address changed.

If you have a retail license or use tax registration you are required to file a tax return even

if there is NO TAX DUE for the period.

IMPORTANT: Complete all lines indicated with a delta ( ) beside it, even if the amount to be reported is zero. The sales tax worksheet

instructions have been changed to use the word “item” when referring to entries on the sales tax worksheet and “line” when referring to

entries on the front of the form.

WHEN FILING "NO SALES" RETURNS, you should enter zeroes on Lines 1, 1A, 1B, and 3 of Column A, B and C only on the front of

ST-388.

COMPLETE THE SALES AND USE TAX WORKSHEET ON THE BACK OF THE ST-388 BEFORE MAKING ENTRIES ON LINES 1

THROUGH 10.

Sales and purchases subject to the State sales tax rate of 5%, 6%, or 7% (a combination of the 5% tax rate as shown in Column B and

2% tax rate as shown in Column C) must be separately reported on Form ST-388 under the appropriate worksheet(s) and column(s).

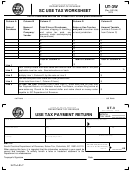

COMPLETING SALES AND USE TAX WORKSHEET #1

STEP 1

Items 1 through 3

Item 1: Gross Proceeds of Sales, Accommodations/Rentals and Withdrawals for Own Use

Enter the total amount of all sales (taxable and nontaxable), leases and/or rentals made by the business for the reporting period. DO

NOT INCLUDE THE AMOUNT OF SALES TAX COLLECTED. Be sure to include your accommodations proceeds.

You must also report purchases of tangible personal property (merchandise, equipment, etc.) purchased tax free at wholesale, but used

by you and/or your employees.

Item 2: Out-of-State Purchases Subject to Use Tax

Enter the total purchases of tangible personal property purchased from an out-of-state retailer for use, storage, or consumption in this

state if an equal amount of sales tax or use tax was not paid at the time of purchase. If the tax rate in your county is greater than the tax

rate paid out-of-state, contact SCDOR for additional information.

Item 3: All Gross Proceeds of Sales/Rental, Use Tax, Accommodations and Withdrawals for Own Use

Add Items 1 and 2. Enter total here and on Line 1 on the front of ST-388. If local tax is applicable, enter this amount on Item 1 of ST-389

worksheet.

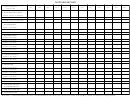

COMPLETING THE 6% SALES AND USE TAX WORKSHEET #2

STEP 2

Items 4 through 9

This section is used for reporting all sales and purchases of tangible personal property (merchandise) subject to the state tax rate of

6%. Sales and purchases generally reported in this section include charges for meals, gift items, additional guest charges, etc.

However, total sales of accommodations are excluded from this worksheet section. Total sales of accommodations (subject to the

7% State sales tax rate) must be recorded on Worksheet #3 (at 5% tax rate) and Worksheet #4 (at 2% tax rate) to determine the total

state sales tax due on accommodations.

Item 4: Gross Proceeds of Sales/Rentals and Withdrawals of Inventory for Own Use

Enter the total amount of all sales, leases and/or rentals of tangible personal property made by the business (taxable and nontaxable)

for the reporting period subject state tax rate of 6%. Allowable deductions (nontaxable sales) are to be itemized on Item 7. DO NOT

INCLUDE THE AMOUNT OF SALES TAX COLLECTED.

You must also report purchases of tangible personal property (merchandise, equipment, etc.) purchased tax free at wholesale, but used

by you and/or your employees.

Item 5: Out-of-State Purchases Subject to Use Tax

Enter total purchases of tangible personal property purchased from an out-of-state retailer for use, storage or consumption in this state

(not otherwise excluded) if an equal or greater amount of sales tax or use tax was not paid in the other state at the time of purchase.

Item 6: Total Gross Proceeds of Sales/Rentals, Use and Withdrawals for Own Use at 6%.

Add Items 4 and 5. Enter total here and on Line 1A, Column A on the front of ST-388.

Item 7: Sales and Use Allowable Deductions

The state sales and use tax law provides several deductions (exemptions and exclusions) for sales and use tax purposes. There are full

and partial deductions for the state sales and use tax. Before any deductions may be itemized (claimed) on your state sales and use tax

return, the gross proceeds of sales must be reported on the state tax return (ST-388) worksheet (Items 1 and 2 of Worksheet #1 and

Items 7 and 8 of this worksheet). To claim a deduction on the state tax return, it should be listed on the State return worksheet by the

type of deduction and the dollar amount.

The list below is used to identify some of the type of deductions that may be shown on the return. Any amount claimed as a deduction

on your return must be itemized on the worksheet.

14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86