Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 36

ADVERTISEMENT

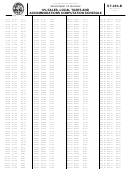

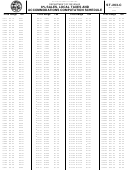

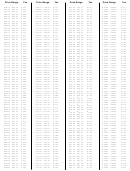

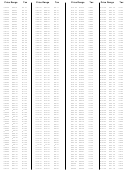

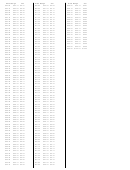

Collection of Catawba Tribal Sales Tax

The Catawba Tribal Sales Tax is set aside in a tribal trust fund for the benefit of the tribe and its members. The

reservation is located in parts of York and Lancaster counties. The chart shown below illustrates the type of tax imposed

and tax rate to be collected from various points of delivery.

New Sales Tax Rate for Catawba Tribal Tax Effective May 1, 2009

Tax Chart of Applicable Tax Type and Rates on Sales to Catawba Reservation

Tax Rate by County

Explanation of Applicable Deliveries

Tax Type

York

Lancaster

Retailers located on the reservation and making a sale (delivery) on the reservation

Tribal Tax

**7%

**8%

Retailers located within the state and off the reservation making a sale (delivery) on the

Tribal Tax

** 7%

**8%

reservation greater than $100.00.

*Retailers located within the state and off the reservation making a sale (delivery)

State Tax

*6%

*6%

on the reservation of $100.00 or less.

Only

*Retailers located outside the state (registered with DOR) making a sale (delivery)

State Tax

*6%

*6%

on the reservation

Only

*Local taxes would not be applicable in these circumstances only.

**Note: The tribal sales tax rates within the Reservation may change in the future. For additional information concerning the tribal

sales tax see SC Revenue Ruling #98-18.

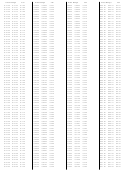

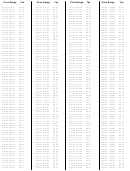

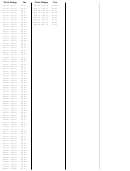

Collection of Tourism Development Tax

The Municipal Council of the City of Myrtle Beach has implemented a 1% Local Option Tourism Development Fee

(referred to as Tourism Development Sales and Use Tax). This tourism development tax is imposed specifically for

tourism advertisement and promotion directed at non-South Carolina residents.

This tax is collected by retailers located in or making sales into the City of Myrtle Beach. Retailers reporting the tourism

development tax must report the tax by the municipality of delivery (as preprinted in Section 7 on Form ST-389). The tax

does not apply to items subject to a maximum tax or the gross proceeds of sales of unprepared food that may lawfully be

purchased with United States Department of Agriculture food coupons.

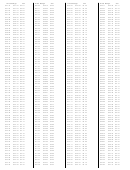

Submit all pages containing applicable data.

page 8 of 8

50638063

35

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86