Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 30

ADVERTISEMENT

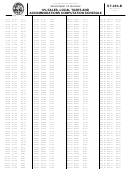

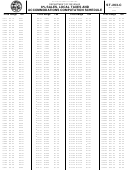

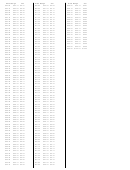

ST-389 WORKSHEET

(If applicable)

The ST-389 is used to report various types of local taxes. Most of the local sales and use taxes reported on the ST-389 provide the

same exemptions. However, some local taxes provide different exemptions from other local taxes. Before claiming a deduction on the

ST-389 worksheet, you must report your gross sales (taxable and nontaxable) on Item 1 of the ST-389 worksheet. Review carefully the

exemptions applicable to the particular local tax or tribal tax since the exemptions may differ from the state tax exemptions or differ from

another local tax exemption.

For instance, the sales of unprepared foods are exempt from the State sales and use tax rate. However, local taxes still apply to sales

of unprepared foods unless the local tax law specifically exempts such sales. Sales of unprepared foods that qualify for local sales and

use tax exemption which also qualified for state sales and use tax exemption should be shown as a deduction on Item 2 of the ST-389

worksheet for local taxes. To obtain information about local tax exemptions, visit our website to obtain a current copy of

the Department’s Policy Document which discusses the types of local taxes imposed and exemptions allowed under each local tax.

Note: When your sales, purchases and withdrawals are made or delivered into a locality with more than one local tax type, the total net

taxable amount on line 1, page 7 of 8 of form ST-389 will not agree with Item 4 of ST-389 worksheet. If this circumstance occurs, you

should complete a separate ST-389 Worksheet for each local tax type and complete the appropriate local tax section on the ST-389 form.

177,000.00

Item 1. Total - Gross Proceeds of Sales/Rental, Use Tax and Withdrawals of

1.

Inventory for Own Use:

As reported on state sales and use tax return worksheet

(Item 3 of ST-3, ST-388, ST-455 or Items 3 and 7 of ST-403.)

Item 2. Local Tax Allowable Deductions

Column A

Column B

Type of Deduction

Amount of Deduction

a. Catawba Sales less than $100.00

$

b. Sales Not Subject to Local Tax

$

13,000.00

Sales to Federal Government

$

$

$

$

<

>

13,000.00

Item 3. Total Amount of Deductions:

3.

Enter the total allowable deductions from Column B.

164,000.00

Item 4. Net Sales and Purchases: (Item 1 minus Item 3.)

4.

Should agree with ST-389, Page 7, line 1, Column A.

Note: This form does not address the local taxes on sales that are collected directly by the counties or municipalities

(sales of accommodations or prepared meals.) It only addresses the general local taxes collected by the Department of

Revenue on behalf of the counties, school districts, and the Catawba Indian tribal government.

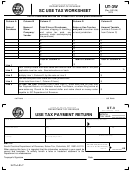

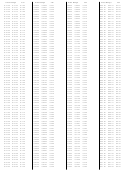

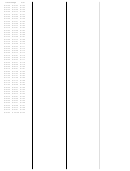

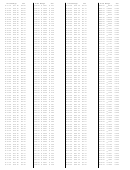

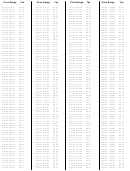

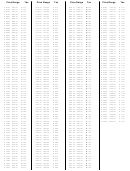

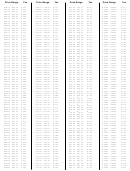

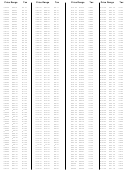

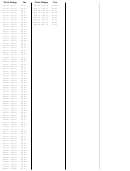

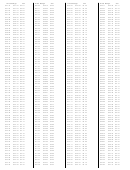

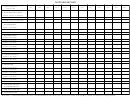

CAPITAL PROJECT, CATAWBA TRIBAL, EDUCATION CAPITAL IMPROVEMENT, SCHOOL

DISTRICT, TOURISM DEVELOPMENT AND TRANSPORTATION TAX NUMERICAL CODES

As a result of specific legislation, certain counties and jurisdictions now impose additional sales and use taxes, which are

identified as Capital Project, Catawba Tribal, Education Capital Improvement, School District, Tourism Development, or

Transportation Tax. These taxes are required to be reported based upon the county or jurisdiction in which the sale

consummates. (Usually this is where the business is located, but it can be the place of delivery or physical presence by

acceptance of the goods sold, if different from the business location.) For your convenience, the counties and jurisdictions

that currently impose these additional taxes are listed on this form with their assigned four digit processing code.

Submit all pages containing applicable data.

page 2 of 8

50632066

29

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86