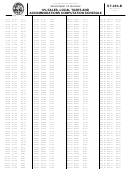

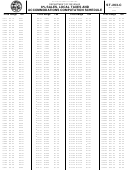

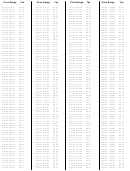

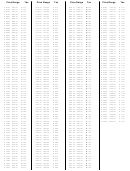

Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 22

ADVERTISEMENT

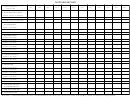

Column C - Discount: A taxpayer's discount may be claimed when the return is filed and the tax due is paid in full on or

before the due date of the return. No discount is allowed if the return or payment is received after the due date. The

discount is computed as follows: Column B times Discount Rate (Use the same discount rate as used on line 5 of applicable

form).

Note: Discounts are not allowed to exceed $3,000 per taxpayer (for all locations) during any one South Carolina fiscal year,

which covers payments made from July 1 through June 30. This includes all returns which become due during this period

(returns for June through May). The $3,000 maximum includes the total discounts for sales/use and local tax. Taxpayers

who file and pay electronically are allowed a $3,100 maximum discount. The discount amount is $10,000 for out-of-state

retailers who cannot be required to register for sales and use tax but who voluntarily register to collect and remit the tax.

However you must receive prior approval from the Department of Revenue for the $10,000 discount.

Column D - Net Amount After Discount: Column B minus Column C. Enter the results in Column D.

For additional entries, reproductions of page 5 are permissible or you may reproduce ST-389A located in the back of the

booklet.

DETERMINE TOTAL AMOUNT DUE

STEP 4

Line 1: Enter total of all net taxable sales listed in Column A of the ST-389 and ST-389-A if applicable, on line 1 on bottom

of page 7. Be sure to include total of all entries from all pages.

Line 2: Add all local taxes due and enter total of Column B, on line 2 of page 7

.

Line 3: Add all net amounts in Column D.

Line 4: Enter the total of Penalty and Interest, from calculations below or visit our website:

PENALTY FOR FAILURE TO FILE A RETURN: The penalty is five percent (.05) of the amount of local tax due (on line 2)

for each month or fraction of a month of delinquency, not to exceed twenty-five percent (.25) of the amount of tax due.

PENALTY FOR FAILURE TO PAY TAX DUE: The penalty is one-half of one percent (.005) of the amount of local tax due

(on line 2) for each month or fraction of a month of delinquency, not to exceed a total of twenty-five percent (.25) of the

amount of tax due.

The penalty for failure to file and pay must be combined and entered as a total on line 4.

INTEREST: Interest is assessed in accordance with Sections 6621 and 6622 of the Internal Revenue Code. Rates are

based on the prime rate, subject to change quarterly and are compounded daily.

Line 5: Add lines 3 and 4.

ENTERING TAX FROM ST-389

STEP 5

Enter the total of Column D from line 5 on the applicable line of your state sales and use tax return as follows:

Line 9 on front of ST-3, ST-388 and ST-455 or

Line 17 on front of ST-403

Make a copy of the completed Form ST-389 for your records.

REMINDER: All pages of Form ST-389 must be attached to the appropriate state form.

DON'T FORGET - Returns are past due if postmarked after the 20th of the month.

If you are not using preprinted forms and it is necessary to use blank forms, be sure to include your Social Security Number

or Federal Employer Identification Number in the space provided on the form.

21

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86