Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 38

ADVERTISEMENT

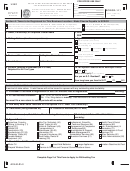

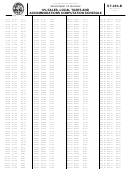

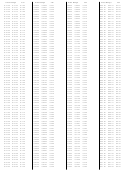

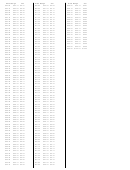

SALES AND USE TAX - Worksheet #1

1.

Item 1.

Gross Proceeds of Sales, Accommodations, Rentals and Withdrawals for Own

Use (Total of All Sales) DO NOT INCLUDE AMOUNT OF SALES TAX.

2.

Item 2.

Out-of-State Purchases Subject to Use Tax

Item 3.

All Gross Proceeds of Sales/Rental, Use Tax, Accommodations and Withdrawals

3.

for Own Use (Add Items 1 and 2. Enter total here and on line 1 on front of ST-388.)

If local tax is applicable, enter total on line 1 of ST-389 worksheet.

Note: Sales of unprepared foods are exempt from the State sales and use tax rate. However, local taxes still apply to sales

of unprepared foods unless the local tax law specifically exempts such sales. Sales that are subject to a local tax must be

entered on Form ST-389 (local sales tax worksheet).

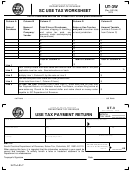

6% SALES AND USE TAX - Worksheet #2

This section is used for reporting the total of all sales and purchases subject to the State sales tax rate of 6%. Sales and purchases

generally reported in this section include charges for meals, gift items, and additional guest charges (such as room service, amenities,

telephone charges, etc.). However, sales of accommodations are excluded from this worksheet section. Total sales of accommodations

(subject to State tax rate of 7%) are reported on Worksheet #3 (for 5% tax reporting) and Worksheet #4 (for 2% tax reporting) to

determine the total State sales tax due.

Item 4.

Gross Proceeds of Sales/Rentals and Withdrawals of Inventory for Own Use

4.

(Sales subject to 6% tax rate requirements)

Item 5.

Out-of-State Purchases Subject to Use Tax

5.

Item 6.

Total Gross Proceeds of Sales at 6% (Add lines 4 and 5. Enter total here and on line

6.

1A, Column A on front of ST-388.)

Item 7.

Sales and Use Tax Allowable Deductions (Itemize by Type of Deduction and Amount of Deduction)

Type of Deduction

Amount of Deduction

.

a. Sales Exempt During "Sales Tax Holiday"

$

b.

Sales over $100.00 delivered onto Catawba Reservation

$

$

$

$

Item 8.

Total Amount of Deductions (Enter total amount of deductions here and on line 2,

<

>

Column A on front of ST-388.)

8.

Item 9.

Net Taxable Sales and Purchases (Item 6 minus Item 8 should agree with line 3,

9.

Column A on front of ST-388.)

REMINDER: Form ST-389 must be completed and attached for all local taxes.

For questions regarding this form, call (803) 896-1420.

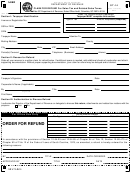

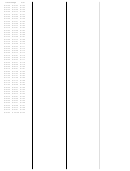

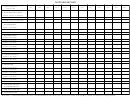

I authorize the Director of the Department of Revenue or delegate to discuss this return, attachments and related tax matters with the

preparer.

Yes

No

Preparer's name and phone number

I hereby certify that I have examined this return and to the best of my knowledge and belief it is a true and accurate return.

Owner, Partner or Title

Printed Name

Taxpayer's Signature

Daytime Phone No.

Date

Internet/E-mail Address:

IMPORTANT: This return becomes DELINQUENT if it is postmarked after the 20th day (return with payment due on or before the

20th) following the close of the period. Sign and date the return.

50622042

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

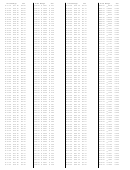

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86