Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 52

ADVERTISEMENT

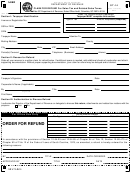

INSTRUCTIONS FOR ST-14

In order for us to verify this refund request and allow us to accurately calculate any applicable tax and interest due, provide

the following supporting documentation when submitting this claim for refund:

1)

Copy of exempt or resale certificate relevant to this claim for refund;

2)

Amended returns by period initially reported; (note: use a blank ST-3 and write “Amended” at the top of the return. A blank

form may be obtained in the sales tax booklet or downloaded from our website: and instructions);

3)

A tax summary of sales/purchase invoices (not actual invoices), which pertain to this request by periods reported: (this

summary should correspond to when the tax was paid on the original tax returns).

NOTE: The following are scenarios where an assignment of refund rights is required for sales and use tax purposes, (see

code section 12-60-470).

A) Sales tax transactions: the seller must request the refund. However, the purchaser may request a refund provided

there is an assignment of refund rights obtained from the seller.

B) Use tax transactions: the purchaser must request the refund. However, the seller may request a refund provided there

is an assignment of refund rights from the purchaser. No assignment is necessary when the seller establishes that he has

paid the tax and refunded the tax to the purchaser.

The assigner should provide by period the amount(s) of tax paid on his/her original return relevant to this request.

The department may also request additional information as deemed necessary to process the request.

TAXPAYERS' BILL OF RIGHTS

You have the right to prompt, courteous service from us in all

You have the right to apply for assistance from the Taxpayer

your dealings with the Department of Revenue.

Rights' Advocate within the Department of Revenue. The

advocate or his designee is responsible for facilitating

You have the right to request and receive written information

resolution of taxpayer complaints and problems.

guides, which explain in simple and nontechnical language,

appeal procedures and your remedies as a taxpayer.

You have the right to request and receive forms, instructions

You have the right to receive notices which contain

and other written materials in plain, easy-to-understand

descriptions of the basis for and identification of amounts of

language.

any tax, interest and penalties due.

Under the provisions of Section 12-4-340 of the 1976 code of laws, any outstanding liabilities due and owing to South Carolina

Department of Revenue for more than 6 months may be assigned to a private collection agency for collecting actions.

Mailing Address: S. C. Department of Revenue, Sales Office Audit, Columbia, SC 29214-0109

Forms Request Line: (800) 768-3676

Internet:

Refund Inquiries: (803) 896-1420

Taxpayer Service Centers

Columbia Main Office:

Greenville Service Center:

Charleston Service Center:

Rock Hill Service Center:

300A Outlet Pointe Blvd.

545 N. Pleasantburg Drive

2 South Park Circle

Business and Technology Center

P.O. Box 125

Greenville, SC 29607

Suite 100

454 South Anderson Road

Columbia, SC 29214

Phone: 864-241-1200

Charleston, SC 29407

Suite 202

Phone: 803-898-5000

Fax: 864-232-5008

Phone: 843-852-3600

P.O. Box 12099

Fax: 803-896-0132

Fax: 843-556-1780

Rock Hill, SC 29731

Phone: 803-324-7641

Fax: 803-324-8289

Florence Service Center:

Myrtle Beach Office:

1452 West Evans Street

1330 Howard Parkway

P.O. Box 5418

Myrtle Beach, SC 29577

Florence, SC 29502

Phone: 843-839-2960

Phone: 843-661-4850

Fax: 843-839-2964

Fax: 843-662-4876

Assistance may also be obtained at one of our "Satellite" office locations. "Satellite" locations and hours can be found at >contact DOR>

other locations.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social

security number as means of identification in administration of any tax. SC Regulation 117-201 mandates that any person required to make a return to

the SC Department of Revenue shall provide identifying numbers, as prescribed, for securing proper identification. Your social security number is used

for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to the information

necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the Department, it is protected by law

from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from

being used by third parties for commercial solicitation purposes.

50172022

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86