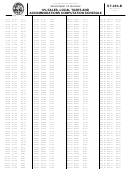

Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 21

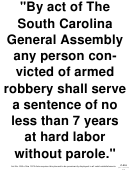

ADVERTISEMENT

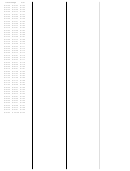

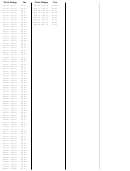

Item 3 Total Amount of Deductions: Enter the total allowable deductions from Column B.

Item 4 Net Sales and Purchases: Item 1 minus item 3. Total should agree with Column A, line 1, page 7 of 8 of form

ST-389.

Note: When your sales, purchases and withdrawals are made or delivered into a locality with more than one local tax type, or

more than one local tax type is reported the total net taxable amount on line 1, page 7 of 8 of form ST-389 will not agree with

item 4 of ST-389 Worksheet. If this circumstance occurs, you should complete a separate ST-389 Worksheet for each local

tax type and complete the appropriate local tax section on the ST-389 form.

Do not take credits on this form. (See ST-14: Claim for Refund form which is located in your booklet and discussed on

the Essential Information section found in your booklet.)

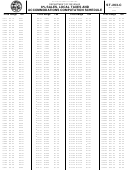

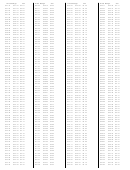

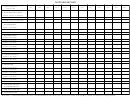

INSTRUCTIONS FOR COMPLETING FORM ST-389, pages 1, 3, 4, 7

STEP 2

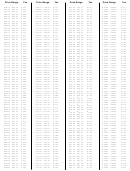

The Form ST-389 is a multi-part form with Capital Projects reported on page 1, School District taxes reported on page 3; and

Transportation, and Catawba Sales Tax reported on page 4. The county names and codes for these taxes are preprinted

only on pages 1, 3 and 4. Local Option taxes are required to be reported on page 5. Use only the codes listed on page 6 of

Form ST-389 to report the location(s) subject to the local option tax. Page 7 is used to report the Tourism Development Tax.

The municipality name and code is preprinted on this page.

If you do not have a pre-printed form, please enter the business name and address, retail license or registration number and

the period ended as shown on Form ST-3, ST-388, ST-403 or ST-455 to which this schedule must be attached.

Use instructions below to complete Columns A, B, C, and D for reporting special local taxes listed on pages 1, 3, 4 and 7 of

ST-389.

CALCULATING LOCAL TAX ON ST-389

Column A Net Taxable Amount: Enter net taxable sales or purchases made for each county or jurisdiction.

Column B Local Tax: Multiply Column A by the applicable tax rate and enter results in Column B for the applicable county

or jurisdiction.

Column C Discount: A taxpayer discount may be claimed when the return is filed and tax is paid in full on or before the due

date of the return. No discount is allowed if the return or payment is received after the due date. The discount is computed by

multiplying the tax amount of Column B by the applicable discount rate (Column B x Discount Rate - Use the same

discount rate as used on line 5 of Form ST-3).

Note: Discounts are not allowed to exceed $3,000 per taxpayer (for all locations) during any one South Carolina fiscal year,

which covers payments made from July 1 through June 30. This includes all returns which become due during this period

(returns for June through May). The $3,000 maximum includes the total discounts for sales/use and local tax. Taxpayers

who file and pay electronically are allowed a $3,100 maximum discount. The discount amount is $10,000 for out-of-state

retailers who cannot be required to register for sales and use tax, but who voluntarily register to collect and remit the tax.

However, you must receive prior approval from the Department of Revenue for the $10,000 discount.

Column D Net Amount After Discount: (Column B minus Column C) Enter total in Column D for each applicable tax to be

reported.

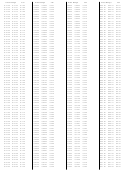

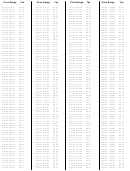

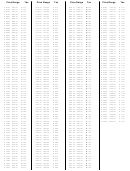

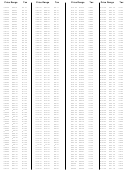

INSTRUCTIONS FOR COMPLETING PAGE 5 LOCAL OPTION PORTION

STEP 3

Name of County or Jurisdiction: Column A is used to identify a particular county or municipality where delivery takes place

in a county with a local option tax. If your business reports a local option tax, you must use the municipality or county name

and code that shows the location where the property is delivered within the county. A list of counties with the municipality

names and codes can be found on page 6 of 8 of Form ST-389. Enter the name of the county or municipality and its code

based upon sales or deliveries within a particular location or municipality.

ONLY ONE ENTRY PER LINE IS ALLOWED. If additional lines are needed, use the ST-389 A (Addendum) located in your

booklet and our website

CALCULATING LOCAL OPTION TAX

Code: Enter the code for the named county or municipality based upon codes identified on page 6 of the Form ST-389.

Use instructions below to complete Columns A, B, C, and D for Local Option Tax.

Column A - Net Taxable Amount: Enter net taxable sales or purchases made for each county or municipality. Credits are

not allowed to be taken on this form. (See ST-14: Claim for Refund form which is located in your booklet and

discussed on the Essential Information section found in your booklet).

Column B - Local Tax: Multiply Column A by 1% (.01) and enter results in Column B for each county or municipality.

20

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

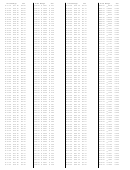

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86