Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 3

ADVERTISEMENT

RESPIRATORY SYNCYTIAL VIRUS PRESCRIPTION SALES AND USE TAX EXEMPTION

The effective date of the exemption from sales and use tax of prescription medicines used to prevent respiratory syncytial

virus shall be January 1, 1999. No refund of sales and use taxes may be claimed as a result of this provision. (Proviso

117.63)

--GENERAL INFORMATION ANNOUNCEMENT--

NOTIFICATION REQUIREMENT OF RENTAL PROPERTY DROPPED FROM LISTING SERVICE

Persons furnishing accommodations are liable for the sales tax imposed on accommodations, whether, such person is the

owner or a real estate agent, listing service, broker or similar listing service handling the accommodations for the owner.

For this reason, such person is required to obtain a retail license and remit the tax to the SC Department of Revenue

(Department).

Under the sales tax law, real estate agents, brokers, corporations or listing services liable for sales tax on

accommodations must notify the Department if rental property, previously listed by them, is dropped from their listings.

According to SC Information Letter #11-19, notification to the Department that rental property for an owner of a home, or

other rental property subject to the sales tax on accommodations is dropped from listings of the real estate agent, broker,

or similar listing service should include: (1) name of the owner (2) address of the owner (3) address of the rental property

and (4) the date the rental property was dropped from the listing of the real estate agent, broker, or similar listing service.

Notification may be sent each time a listing is dropped, but does not need to be. The notification should be sent to the

South Carolina Department of Revenue twice a year – once by July 31st for all listings dropped from January through

June and once, by January 31st, for all listing dropped from July through December. The notification information should

be sent to the following address:

South Carolina Department of Revenue

Sales Office Audit – Accommodations Notification Information

P.O. Box 125

Columbia, South Carolina 29214

A complete copy of SC Information Letter #11-19 can be obtained from the South Carolina Department of Revenue’s

website,

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

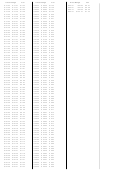

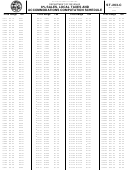

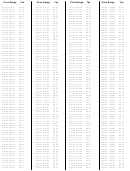

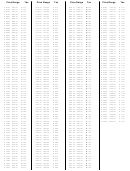

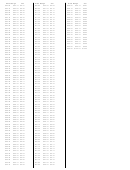

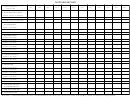

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86