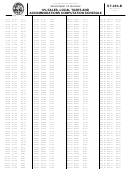

Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 9

ADVERTISEMENT

Accommodations Tax

tax. Many catalog and mail-order companies already

collect South Carolina's sales or use tax when you make a

The rental of transient accommodations is subject to a

purchase. If the business does not collect the tax at the

2% accommodations tax in addition to the 5% sales tax

time of purchase, you are responsible for reporting the

(and the percentage for local tax, if applicable). If you

purchase and paying the tax yourself. If you make a

rent out rooms or spaces at hotels, campsites, boarding

purchase in another state and pay less than the tax which

houses, etc., you are required to obtain a retail license

would be due in South Carolina, you should report and

and pay the sales and accommodations tax.

pay the difference to the SC Department of Revenue. A

credit is allowed for Sales or Use Tax due and paid in

Room rentals to the same person for at least 90

another state.

continuous days are not subject to the tax. If you rent a

room in the house in which you live and it has less than

Business

six bedrooms, you are exempt from the tax. If you rent

transient accommodations for no more than one week

Businesses which regularly make non-taxed purchases

each calendar quarter, you are not required to obtain a

out of state report and pay the use tax on their monthly

retail license, but you still must report and pay the tax

sales and use tax return, ST-3 and ST-389, if applicable.

annually. Additional guest charges such as movie

rentals, room service, valet services, etc. are subject to

Personal

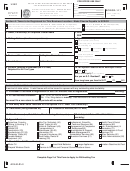

the 6% sales tax. ST-388 is used to report your Sales,

Use and Accommodations taxes and must be submitted

Individuals not in business who make non-taxed

with form ST-3T.

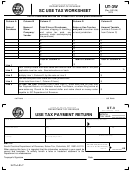

purchases out of state should report the use tax on

UT-3/UT-3W, SC Use Tax Worksheet or visit the

Maximum Tax

Department’s webpage, , to pay the use

tax or report and pay the tax on the South Carolina

A maximum sales tax of $300 is imposed on the sale or

Individual Income Tax Return.

lease of motor vehicles, boats, aircrafts, motorcycles,

certain trailers, recreational vehicles and light construction

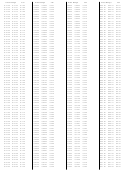

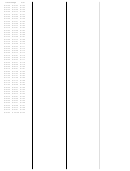

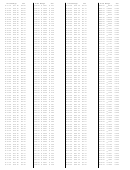

Local Sales and Use Taxes

equipment. For purchases of light construction equipment,

the Form ST-405 is to be filled out by the purchaser and

A county may approve one or more of the following local

given to the retailer to limit the tax amount to three

taxes: local option, capital projects, school district,

hundred dollars ($300). The $300 limit also applies to the

tourism development, or transportation tax. These local

sale of musical instruments and office equipment to

sales and use tax taxes are imposed in addition to the

religious organizations. Form ST-382 must be completed

State sales and use tax. These local taxes are collected

for these items sold to religious organizations. Retailers

and administered by the South Carolina Department of

who sell items subject to a maximum will be receiving the

Revenue on the behalf of the counties. Items subject to a

ST-455 (State, Sales, Use, Maximum and Special Filers

maximum sales and use tax (i.e. $300 on motor vehicles)

Return) with instructions for the form. The ST-455 is to be

are exempt from the local sales and use taxes.

used for reporting sales subject to the 1% sales tax rate

increase as well as those not subject to the 1% sales tax

Voters may approve 1% local option sales and use tax

(Items subject to a maximum tax) rate increase as of June

and/ or a local tax for capital projects, education capital

1, 2007.

improvement, school districts, tourism development, or

transportation tax.

Manufactured Homes

Counties and municipalities may impose local hospitality

The first 35% of the selling price of a manufactured home

taxes

on

food,

beverages,

accommodations

and

is exempt from sales and use tax. After allowing for the

admissions. This form does not address the local taxes

exemption and any trade-in, the tax imposed on the sale is

on sales that are collected directly by the counties or

$300 plus 2% of the remaining sales price exceeding

municipalities (sales of accommodations or prepared

$6,000. The 2% may be waived if certain energy efficiency

meals). These

taxes are

collected by

the local

levels are met in the mobile home. Furniture and

government, not the Department of Revenue. Contact the

appliances that are not permanently attached and are sold

county where your business is located to determine if you

with a mobile home must be listed separately on the bill or

are liable for any of their local hospitality taxes.

invoice and taxed at 6% of the sales price (less any

trade-in allowance), plus applicable local taxes.

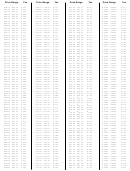

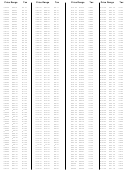

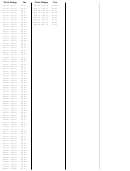

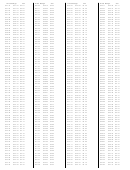

The local tax rate information presented in this publication

is current at the time of publication. To determine if the

In 2008, the maximum tax provision relating to the

local tax information relating to a particular county or

calculation of the maximum tax for manufactured homes

jurisdiction

has

changed,

visit

our

website,

was amended to completely exempt certain Energy Star

, and inquire under sales and use tax.

homes from the sales and use tax for sales occurring from

July 1, 2009 through July 1, 2019. Under this provision,

the manufactured home would be exempt 100% from any

+Tax/Sales+and+Use+Tax+Publications.htm

sales and use tax calculation due if it has been designated

by the United States Environmental Protection Agency and

Tax Rate on Unprepared Food

the United States Department of Energy as meeting or

exceeding each agency's energy saving efficiency or

Sales of unprepared food items eligible for purchase

meeting or exceeding such requirements under each

with United States Department of Agriculture food

agency's Energy Star program.

coupons are exempt from the State sales and use tax.

This exemption does not apply to local sales and use

More Information

taxes administered and collected by the S. C.

Department of Revenue on the behalf of counties and

For more information on sales and use tax, visit the

other jurisdictions unless the local tax law specifically

Department of Revenue's home page on the Internet:

exempts sales of such food. To obtain additional

Sales tax laws, regulations,

information relating to sales of unprepared food, visit

policy documents and attorney general opinions may be

our website to view SC Regulation 117-337.

found there.

This publication is intended to provide basic information about sales

and use tax. It is not a substitution for the law. Further, tax laws

change rapidly. We would advise you to seek legal advice if there are

questions about your tax obligations.

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86