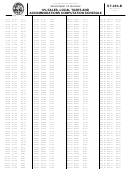

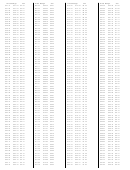

Sales, Use, Accommodations And Local Sales Tax Booklet - Forms And Instructions - South Carolina Department Of Revenue - 2014 Page 49

ADVERTISEMENT

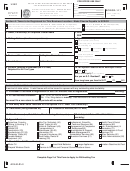

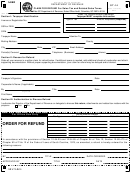

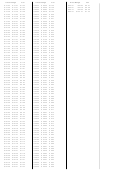

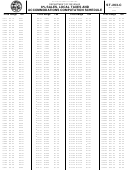

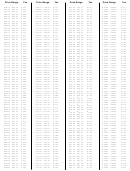

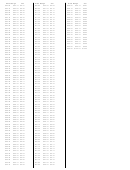

NOTE: DO NOT TAKE CREDITS OR REPORT NEGATIVE AMOUNTS ON THIS FORM.

To apply for refunds, see ST-14.

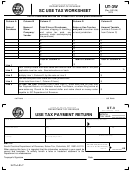

Retail License or Use Tax

Registration Number

Business Name

of

Period ended

Page

Name

Code

Net Taxable

Local

Discount

Net Amount

of County

Amount

Tax

After Discount

or Jurisdiction

7. TOURISM DEVELOPMENT TAX

34-2740

(A)

(B)

(C)

(D)

x 1% =

-

=

MYRTLE BEACH

2615

x 1% =

-

=

x 1% =

-

=

x 1% =

-

=

x 1% =

-

=

x 1% =

-

=

x 1% =

-

=

x 1% =

-

=

x 1% =

-

=

x 1% =

-

=

x 1% =

-

=

x 1% =

-

=

x 1% =

-

=

x 1% =

-

=

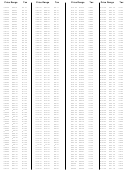

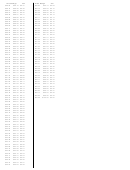

SUMMARY: Complete all pages of the ST-389 first, then enter totals here.

1. Add Column A from pages 1, 3, 4, 5, 7

and all ST389-A's. ...................................... 1

2. Add Column B from pages 1, 3, 4, 5, 7 and all ST389-A's......................

2

3. Add Column D from pages 1, 3, 4, 5, 7 and all ST389-A's .................................................................

3

4. Penalty ________________ Interest ________________

OFFICE USE ONLY: _________________

4

(Add Local Tax Penalty and Interest)

5. Total (Add lines 3 and 4) ....................................................................................................................

5

Enter amount on line 9 of ST-3, ST-388, ST-455 or line 17 of ST-403.

NOTE: Other counties may adopt local taxes at a later date.

For answers to questions pertaining to completing this form, please call (803) 898-5788.

Mail to: Department of Revenue, Sales Tax, Columbia, SC 29214-0101

Submit all pages containing applicable data.

page 7 of 8

50637065

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

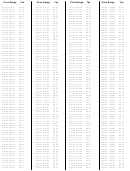

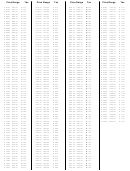

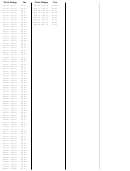

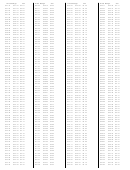

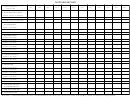

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82 83

83 84

84 85

85 86

86