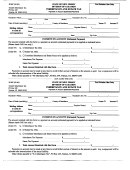

WORKSHEET 1

METHOD 1

SIMPLIFIED TAX COMPUTATION

Decedent's Name

Decedent's SS NO

This is an optional method of computing the tax. It is used when the representatives of the estate choose

not to file the information required for Methods 2, 3 and 4 and therefore choose not to compute the tax

using Methods 2, 3 and 4. This method allows the representative to pay tax on the gross value of the New

Jersey real and tangible personal property at a 15% rate and file a minimal amount of paperwork. If the real

estate is subject to a mortgage, the balance due on the decedent's date of death is deducted on Schedule

"A".

IMPORTANT INSTRUCTIONS

1. If the decedent owned real estate located in New Jersey on his/her date of death complete Schedule "A".

Include New Jersey real estate only.

2. If the decedent owned tangible personal property located in New Jersey on his/her date of death complete

Schedule "B(1)" . Include New Jersey tangible personal property only. Examples of tangibles personal

property are household furniture, automobiles, boats, artwork, jewelry and other items located in New

Jersey either permanently or for an indefinite period of time.

3. If the decedent, during the 3 year period prior to his/her date of death, transferred New Jersey real estate

or tangible personal property without receiving the total (actual) fair market value of the property

transferred or if the decedent transferred New Jersey real or tangible personal property but retained a

right in the property for his/her lifetime then complete the bottom section of Schedule "E".

TAX COMPUTATION WORKSHEET

1. Enter total from Schedule A……………………………………………... …..

1

2. Enter total from Schedule B (1)……………………………….. …………….

2

3. Enter total from Schedule E……………….………………………………….

3

4. Total of above lines 1, 2 and 3…………………………………………………

4

x 15%

5. Multiply line 4 by 15%....................................................................................

5

6. New Jersey Non-Resident Inheritance Tax……………………....................

6

(Insert this number on IT-NR page 1 line 11)

Page 8

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41