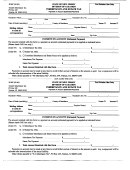

INSTRUCTIONS FOR IT-NR PAGE 1

Lines 8, 12 and 13

With respect to the payment of the tax due on an executory

In the case of a transfer or transfers made subject to a

devise, or a transfer subject to a contingency or power of

contingency or condition which renders a definite determination of

appointment, any payment on such a transfer after the expiration of

the Transfer Inheritance Tax due impossible, the Division will

two months from the date the contingency occurs or the property

suggest a compromise of the tax based upon immediate payment

vests, shall bear interest at the rate of 10% per annum.

and final disposition of the tax. N.J.A.C. 18:26-2.14, N.J.S.A.

In any case where a contingent remainder vests in beneficial

54:36-6 AND 54:36-5.

possession and enjoyment subsequent to the death of the original

Therefore, enter on Line 8, the amount of the estate that is

decedent, but prior to the expiration of the statutory interest period,

“Contingent”.

interest on the contingent tax does not start to accrue until eight

months from the date of death of the original decedent.

In the event you wish to compute a compromise for the

Division’s review, you should include a rider setting forth full

computations and details and enter the proposed amount on Line

Line 17

12.

Following this procedure may speed the auditing of the

Payments on account may be made at any time to avoid

decedent’s return.

further accrual of interest on the amount so paid. Any overpayment

Be advised that where all or any portion of the contingent

will be refunded upon determination of the amount actually

amount has vested in a beneficiary by reason of the happening of

payable provided that such determination is made within three

any contingency event, full details should be set forth on a rider,

years of the date of the actual payment. Make checks payable to:

the tax computed on a rider and entered on Line 13.

NJ Inheritance and Estate Tax, PO Box 249, Trenton, NJ 08695-

0249.

Line 18

Line 15

When making a payment with the return, complete form NR-

Interest accrues at the rate of 10% per annum on any tax due

PMT and attach check.

or portion thereof not paid within eight months of the decedent’s

death.

Examples of Interest Computations

Date of Death . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-28-90

Interest Date (eight months) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-28-91

Tax Assessed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$7,120.48

Interest @ 10% per annum from 1-28-91 to 9-19-91 ($7,120.48 x 10% x 234/365) . . . . . . . . . . . . . . . . . . .

456.49

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7,576.97

Payment on Account (9-19-91) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(7,120.48)

Balance Due (plus interest @ 10% per annum from 9-19-91 to date of final payment) . . . . . . . . . . . . . . . . . .

456.49

Date of Death . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8-29-90

Interest Date (eight months) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-29-91

Tax Assessed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$68,389.70

Payment on Account (4-19-91) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(16,974.56)

Balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

51,415.14

Payment on Account (4-28-91) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(31,927.02)

Balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19,488.12

Interest @ 10% per annum from 4-29-91 to 5-10-91 ($19,488.12 x 10% x 11/365) . . . . . . . . . . . . . . . . . . .

58.73

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19,546.85

Payment on Account (5-10-91) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(27,048.67)

Overpayment (to be refunded) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7,501.82

IT-NR - Page 2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41