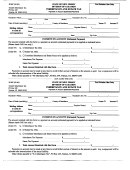

INSTRUCTIONS FOR SCHEDULE “C”

If any notes, brokerage accounts or other claims are secured by collateral, describe the collateral pledged, with

its value as of the date of death of the decedent and state whether or not said collateral is included among the assets

disclosed in Schedule B or B(1). If collateral is not pledged, state after each loan “No collateral pledged”.

NOTE: No debt or claim is to be listed in this schedule unless still owing and unpaid at the time of death and unless

such debt or claim is to be paid out of the assets of the estate.

(EXAMPLE: That portion of medical bills paid or reimbursed by Medicare or other medical insurance

should not be claimed on this schedule).

Contested claims must be explained in detail. Do not list any taxes, either real, personal or

income, chargeable for any period subsequent to date of death.

The estate agrees to advise the Division if the amount actually paid in settlement of any fee, commission or debt

is greater or less than the estimated amount allowed and further agrees to the correction of the assessment, if

necessary.

For mortgages see instructions for Schedule “A”.

Executor Commissions: See N.J.A.C. 18:26-7.10 or questions 25, 26 and 27 New Jersey Non-Resident

Inheritance Tax Most Frequently Asked Questions or Taxation’s website for guidelines on how to compute same.

Examples of Allowable Deductions

FUNERAL EXPENSES:

Cost on recovery and/or discovery of assts

Cemetery Plot (immediate family)

Realty commissions in accordance with N.J.A.C. 18:26-7.12

Funeral Luncheon

Storage of property if delivery to legatee not possible

within reasonable time

Flowers

Minister/Rabbi/Priest/Imam

Monument/Lettering

DEBTS OF DECEDENT OWING and

Funeral Costs

UNPAID AT TIME OF DEATH:

Acknowledgments

Personal accounts

Judgments

ADMINISTRATION EXPENSES:

Federal income and gift taxes

Appraisal of real estate

Real estate mortgage:

Appraisal of personal effects

(a) Interest accrued before death, deducted in

Surrogate’s fees

Schedule C

Probate expenses

(b) Principal offset in Schedule A

Fee to notify creditors

Charitable pledges

Death certificates

State, county and local taxes accrued before death

Telephone tolls

Unpaid Inheritance Tax on interrelated estate

Cost of Executor’s or Administrator’s Bond

Transfer Taxes paid to other states

Collection costs

Debts on property located outside of New Jersey

Court costs

Cost on recovery and/or discovery of assets

Examples of Non-Allowable Deductions

Contingent liabilities

Storage expense

Mortgage, taxes and accrued interest on tenants by entirety

Litigated and disputed claims

property

State, county and local taxes accruing after date of death

Debts paid by insurance

New Jersey Transfer Inheritance Tax

Medical expenses paid prior to death

Real estate brokers commissions, except if real property sold

Liabilities of corporation of which decedent was a

during administration of estate

shareholder

Federal Estate Tax

Real estate and property maintenance costs

IT-NR - Page 10

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41