INTRODUCTION

NEW JERSEY TRANSFER INHERITANCE TAX - ESTATE TAX

GENERAL

New Jersey has had a Transfer Inheritance Tax since 1892 when a 5% tax was imposed on property transferred from a decedent

to a beneficiary. Currently, the law imposes a graduated Transfer Inheritance Tax ranging from 11% to 16% on the transfer of real and

personal property with a value of $500.00 or more to certain beneficiaries. There is no New Jersey Estate Tax for the estates of non-

resident decedents.

BENEFICIARY CLASSES

The issue of stepchildren ARE Class “D” (NOT Class “A”)

The Transfer Inheritance Tax recognizes five beneficiary classes, as

beneficiaries.

follows:

The following ARE Class “D” (NOT Class “C”) beneficiaries:

Class “A” - Father, mother, grandparents, spouse/civil union

stepbrother or stepsister of the decedent, husband/wife/civil union

partner (on or after 2/19/07), domestic partner (on or after 7/10/04),

partner/domestic partner or widow/widower/surviving civil union

child or children of the decedent, adopted child or children of the

partner/surviving domestic partner of a step-child or mutually

decedent, issue of any child or legally adopted child of the decedent

acknowledged child of the decedent.

and step-child but not step-grandchild of the decedent.

The fact that a beneficiary may be considered “nonprofit” by

Class “B” - Eliminated by statute effective July 1, 1963.

the Internal Revenue Service does not necessarily mean that it

Class “C” - Brother or sister of the decedent, including half brother

qualifies for exemption as a Class “E” beneficiary since the criteria

and half sister, wife/civil union partner (on or after 2/19/07) or

are different.

widow/surviving civil union partner (on or after 2/19/07) of a son

TAX RATES

of the decedent, or husband/civil union partner (on or after 2/19/07)

Each class of beneficiary has is own separate tax rate. See the

or widower/surviving civil union partner (on or after 2/19/07) of a

Rate Schedule below:

daughter of the decedent.

Class “D” - Every other transferee, distributee or beneficiary who

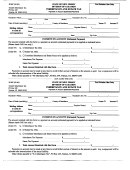

CLASS “A” AND “E” BENEFICIARIES AND TRANSFEREES

is not included in Classes “A”, “C” or “E”.

ARE ENTIRELY EXEMPT

Class “E” - The State of New Jersey or any political subdivision

_________________________________

thereof, or any educational institution, church, hospital, orphan

CLASS “C” BENEFICIARIES AND TRANSFEREES

asylum, public library or Bible and tract society or to, for the use of

or in trust for religious, charitable, benevolent, scientific, literary or

Exempt

First

$

25,000

educational purposes, including any institution instructing the blind

11%

in the use of dogs as guides, no part of the net earnings of which

Next

1,075,000

inures to the benefit of any private stockholder or other individual

13%

Next

300,000

or corporation; provided, that the exemption does not extend to

.

14%

Next

300,000

transfers of property to such educational institutions and

organizations of other states, the District of Columbia, territories

16%

Over

1,700,000

and foreign countries which do not grant an equal, and like

exemption on transfers of property for the benefit of such

CLASS “D” BENEFICIARIES AND TRANSFEREES

institutions and organizations of this State.

15%

NOTES:

If any beneficiary is claimed to be the mutually

First

$

700,000

acknowledged child of the decedent, said claim should be set forth

16%

Over

700,000

in the detailed manner prescribed under N.J.A.C. 18:26-2.6.

For the purposes of the New Jersey Transfer Inheritance Tax

an adopted child is accorded the same status as a natural child and,

EXEMPTIONS

therefore, his relations are treated in the same manner as those of a

1. The transfer of real property in this State held by a husband

natural child. (i.e. if the decedent’s adopted son marries/enters into

and wife/civil union couple as “tenants by the entirety” to the

a civil union, his spouse/civil union partner is “the wife/civil union

surviving spouse/civil union partner is not taxable for New

partner of a son of the decedent” and therefore a class “C”

Jersey Inheritance Tax purposes.

beneficiary).

2. The transfer of intangible personal property such as stocks,

The offspring of a biological parent conceived by the artificial

bonds, corporate securities, bank deposits and mortgages

insemination of that parent who is a partner in a civil union is

owned by a nonresident decedent is not subject to the New

presumed to be the child of the non-biological partner. In the

Jersey Inheritance Tax. However, it is used to compute the

Matter of the Parentage of the Child of Kimberly Robinson, 383

New Jersey resident tax on the appropriate worksheet.

N.J. Super. 165; 890 A.2d 1036 (Ch. Div. 2005) (Non-biological

parent of New York registered domestic partnership recognized in

3. Any sum recovered under the New Jersey Death Act as

New Jersey, presumed to be the biological parent of child

compensation for wrongful death of a decedent is not subject

conceived by the other partner through artificial insemination

to the New Jersey Inheritance Tax except as provided below:

where the non-biological partner has "show[n] indicia of

a. Any sum recovered under the New Jersey Death Act

commitment to be a spouse and to be a parent to the child.").

representing damages sustained by a decedent between the

A devise of real property to a husband and wife or civil union

date of injury and date of death, such as the expenses of

couple as “tenants by the entirety” provides each with a vested life

care, nursing, medical attendance, hospital and other

estate, the remainder being contingent. See N.J.A.C. 18:26-8.12.

charges incident to the injury, including loss of earnings

2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41