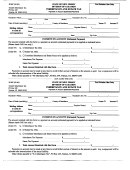

WORKSHEET 2

RATIO TAX USING NET ESTATE

METHOD 2

DIRECTIONS FOR COMPLETING THE INHERITANCE TAX RETURN USING THE INFORMATION GIVEN IN EXAMPLE 1 ON PAGE 14.

Schedule A

Enter the description and values of the New Jersey and Pennsylvania real estate.

Schedule B

Since there are no assets of this type owned enter the word "none".

Schedule B(1)

Enter the description and values of the bank accounts, stock, and boat.

Schedule C

Attorney's fees, executor's commissions, and administration expenses are entered in the

upper section of the schedule. Note that the expenses in this section are added and entered

on the subtotal line. Then this total is entered on line 4 of worksheet 2. In this example

the subtotal is $6,300. Credit card debt, telephone and electric bills and funeral expenses

are entered in the lower section of the schedule. The expenses on the entire schedule are then

added to give you the total expenses of the estate. In this example the total expenses

are $20,530.

Schedule E

Answer the questions at the top of the schedule. If any are answered yes then complete the bottom

section.

Schedule F

Enter the name and address of each beneficiary and complete each column.

Directions for completing the worksheet using the numbers given in the example .

Line 1 Enter the total value of the New Jersey real estate ($100,000) and the boat ($10,000) that was

kept in New Jersey.

Line 2 Enter the gross estate everywhere ($500,000).

Line 3 Divide line 1 by line 2 to get the ratio of the New Jersey taxable assets to the total (gross)

estate everywhere. All decimals are to be carried to 4 places. The ratio in this example is .2200.

Line 4 Enter the amount from the subtotal line in Schedule "C".

Line 5 Multiply line 4 by line 3. This gives you the portion of the expenses listed on line 4 which

will be subtracted from the value of the New Jersey assets listed on line 1. ($1,386)

Line 6 Subtract line 5 from line 1. This gives you a reduced value of the New Jersey assets that

will be taxed. ($108,614)

Line 7 Enter the value of the net estate from IT-NR page 1, line 7. ($479,470).

Line 8 Divide line 6 by line 7. This gives you the ratio of the reduced value of the New Jersey

assets to the total net estate everywhere. The ratio in this example is .2265.

Line 9 Enter the New Jersey resident tax on the total net estate everywhere. Since the beneficiary

in this estate is a Class "D" beneficiary (the tax rate for a Class "D" beneficiary is 15%) the tax is

computed by multiplying the net estate by 15% ($479,470 X 15%). The result is $71,920.50.

This is the tax that would be due if the decedent was a resident of New Jersey and all of his assets

listed in the example were located in New Jersey.

Line 10 Multiply the amount on line 9 by the ratio on line 8. This gives you the New Jersey

Non-resident Inheritance Tax $16,290.00. Insert this number on IT-NR page 1, line 11.

WORKSHEET 2 - METHOD 2

RATIO TAX USING NET ESTATE

1 Gross value of New Jersey real estate & tangible personal property

1

110,000.00

[from Schedule "A" and/or "B(1)"]

2 Total gross estate wherever situate (IT-NR page1, line 5)

2

500,000.00

3 Gross to gross ratio (line 1 divided by line 2)

3

0.2200

4 Total of administration expense, counsel fees and commissions

4

6,300.00

(from subtotal line of Schedule "C")

5 Deduction from gross value of NJ taxable property

5

1,386.00

(Line 4 multiplied by line 3)

6 Net New Jersey taxable property (line 1 minus line 5)

6

108,614.00

7 Net estate wherever situate (IT-NR, page 1, line 7)

7

479,470.00

8 Ratio (line 6 divided by line 7) (not to exceed 100%)

8

0.2265

9 New Jersey Resident Tax on amount reported on line 7

9

71,920.00

(see page 2 of instructions for classes of beneficiaries and tax rates)

10 New Jersey Non-Resident Ratio Tax (Line 8 multiplied by line 9)

10

16,290.00

(insert this number on IT-NR page 1, line 11)

All decimals are to be rounded to four places.

Page 17

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41