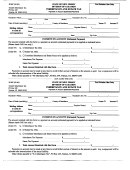

WORKSHEET 6

COMBINATION DIRECT TAX AND RATIO TAX USING GROSS ESTATE WORKSHEET

Decedent's Name

Decedent's SS NO

For use when there are two (2) or more New Jersey taxable assets and at least one of them is

specifically devised or jointly owned (joint tenants with right of survivorship), or transferred to one or

more individuals within three (3) years of the decedent's death, or to take effect at or after the

decedent's date of death and the other New Jersey taxable assets are held in the decedent's name

alone or as tenants in common with another individual.

If the New Jersey taxable property or any amount thereof is specifically devised or jointly owned

(joint tenants with right of survivorship), or transferred as indicated above, that amount is not subject

to the ratio tax but rather is taxed directly to the devisee(s) or surviving joint tenant(s) at the resident

tax rates.

TAX COMPUTATION WORKSHEET

1. Direct tax on New Jersey taxable property specifically devised, jointly

owned, or transferred as indicated above. Use worksheet 4, page 11

to compute the tax for this line……………………………………………..

1

2. Value of New Jersey taxable property not specifically devised, jointly

owned, or transferred as indicated above………………………………… 2

3. Value of gross estate both in and outside of New Jersey (not including

the New Jersey property specifically devised, jointly owned, or

transferred as indicated above) (IT-NR Page 1, Line 5 less New

Jersey property described herein)………………………………………..

3

4. Ratio (Line 2 divided by Line 3) …………………………………………

4

5. New Jersey resident tax on amount reported on Line 3 above (see

page 2 of the instructions for classes of beneficiaries and tax rates)...

5

6. New Jersey Non-Resident ratio tax on the amount reported on line 3.

(Line 4 multiplied by Line 5) …………………………………..………….

6

7. Total New Jersey direct tax and ratio tax (Line 1 plus Line 6)

(Insert this amount on IT-NR Page 1, Line 11)………………………….

7

NOTE

In the event that any amount of the estate is contingent, the ratio calculated on Line 4 above should

be applied to the resident compromise tax to compute the nonresident compromise tax due.

All decimals are to be rounded to four places.

Page 13

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41